Banking Process Step by Step

- Choose Your Account Type – Select the account type that suits your financial needs.

- Gather Required Documents – Ensure you have all necessary documents before applying.

- Visit a Branch or Apply Online – Depending on your eligibility, you can open an account online or visit a Capital One branch.

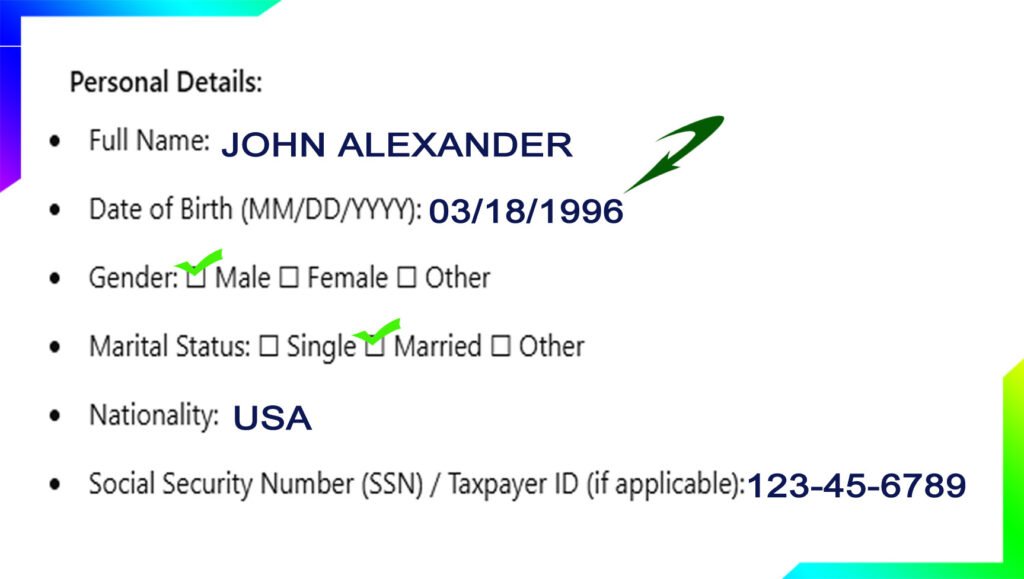

- Complete the Application Form – Fill out the application form with accurate details.

- Submit KYC & Biometric Updates – Provide identification and biometric details for verification.

- Fund Your Account – Deposit the minimum required balance.

- Activate Your Account – Once verified, you’ll receive account details and online banking access.

Account Types

- Checking Accounts – Everyday banking with easy access.

- Savings Accounts – Earn interest on your savings.

- Money Market Accounts – Higher interest rates with flexible withdrawals.

- Fixed Deposit Accounts – Locked-in interest rates for a fixed term.

- Senior Citizen Accounts – Special benefits for seniors.

- MIS (Monthly Income Scheme) Accounts – Fixed monthly interest payouts.

Account Opening Forms & Online System

- Download from the official Capital One website.

- Online application available for select accounts.

- Digital document submission for verification.

Required Documents

For Residents:

- Social Security Number (SSN)

- Government-issued ID (Passport/Driver’s License)

- Proof of Address (Utility Bill/Lease Agreement)

For Non-Residents:

- Passport with valid visa

- ITIN (Individual Taxpayer Identification Number) if applicable

- Proof of foreign address

- U.S. address proof (if available)

KYC & Biometric Updates

- Know Your Customer (KYC) – Regular updates required for identity verification.

- Biometric Verification – Fingerprint or facial recognition for security.

Account Opening Charges & Minimum Balance

- Checking Accounts: $0–$50 (varies by account type)

- Savings Accounts: Minimum balance requirements vary

- Fixed Deposits: Minimum deposit starts from $500

Interest Rate Charts (2025)

Daily Interest Rate Chart

| Account Type | Interest Rate (%) |

|---|---|

| Savings Account | 0.50% – 1.50% |

| Money Market Account | 1.00% – 2.00% |

Yearly Interest Rate Chart

| Account Type | Interest Rate (%) |

| Regular Savings | 1.50% – 2.50% |

| Fixed Deposits | 3.00% – 5.00% |

Fixed Deposit Rate Chart

| Term | Interest Rate (%) |

| 6 Months | 3.00% |

| 1 Year | 3.50% |

| 5 Years | 5.00% |

Senior Citizen Scheme Facilities

- Additional 0.50% interest on fixed deposits.

- Priority customer service.

- No maintenance fees on select accounts.

Monthly Income Scheme (MIS)

- Fixed monthly interest payouts.

- Ideal for pensioners and retirees.

- Deposit tenure options from 1 to 5 years.

Insurance Services

- Life & Health Insurance Plans

- Travel & Auto Insurance

- Home Insurance

Mobile Apps & Online Payment Methods

- Capital One Mobile App – Manage accounts, deposit checks, transfer funds.

- Online Banking – Bill payments, fund transfers, and mobile deposits.

- Payment Methods – ACH transfers, wire transfers, debit cards, and credit cards.

Customer Facilities

- 24/7 Customer Support

- Free ATM withdrawals at Capital One ATMs

- Cashback offers on debit & credit card transactions

Bank Details

- Official Website: Capital One

- Customer Service: 1-877-383-4802

New Updates in 2025

- Higher fixed deposit rates.

- Enhanced mobile banking features.

- New cashback offers on select transactions.

FAQ

1. Can a non-resident open a Capital One account online?

Yes, but you may need to visit a branch for identity verification.

2. What is the minimum deposit to open a fixed deposit account?

Minimum deposit starts at $500.

3. How long does it take to open an account?

Online accounts can be opened within minutes, while in-branch verification may take a few days.

4. What are the benefits of a senior citizen account?

Higher interest rates, no maintenance fees, and priority service.

5. How can I access my account online?

Use the Capital One website or mobile app for account management.