How to Open an Account with Old National Bank USA: A Comprehensive Guide for Residential & Non-Residential Customers

Opening a bank account is a crucial step in managing your finances, whether you are a resident or a non-resident in the USA. Old National Bank, one of the leading financial institutions in the country, offers a seamless process for account opening, both online and offline. This guide we’ll walk you through the step-by-step process, required documents, account types, fees, interest rates, and other essential details to help you make an informed decision.

Account Opening Process Step by Step

1. Choose Your Account Type

Old National Bank offers a variety of account types to suit different needs:

- Checking Accounts: For everyday transactions.

- Savings Accounts: To grow your savings with interest.

- Money Market Accounts: Higher interest rates with check-writing privileges.

- Certificates of Deposit (CDs): Fixed-term deposits with guaranteed returns.

- Senior Citizen Accounts: Special benefits for customers aged 55 and above.

- Business Accounts: For non-residents or businesses operating in the USA.

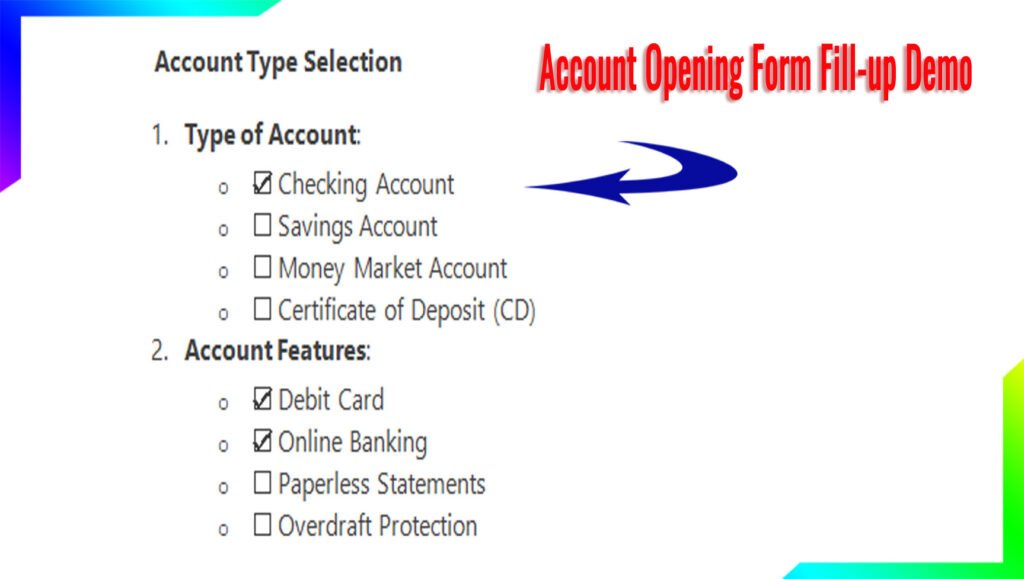

2. Online Account Opening Process

- Visit the official Old National Bank website: www.oldnational.com.

- Navigate to the “Open an Account” section.

- Select the type of account you wish to open.

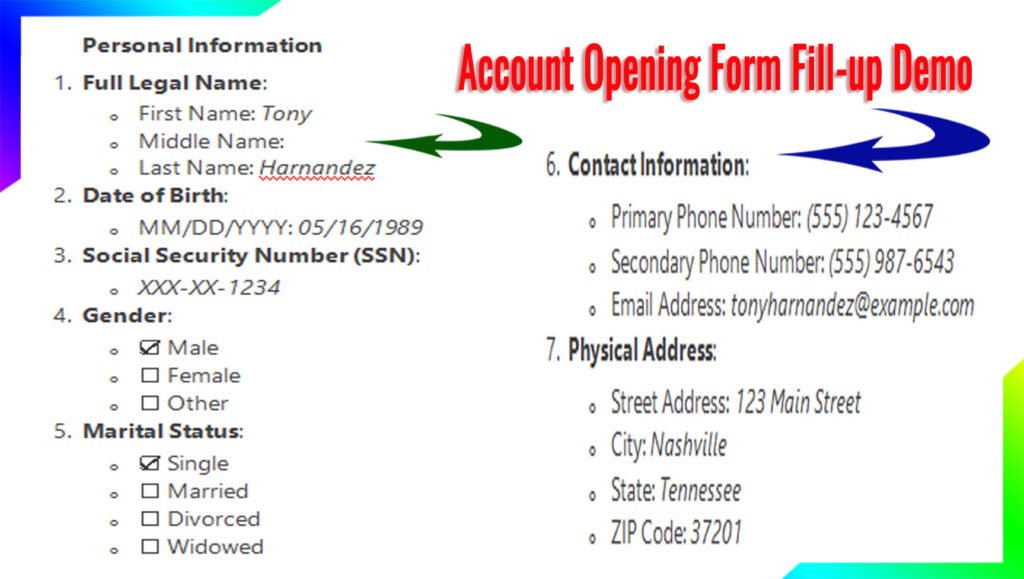

- Fill out the online application form with your personal and contact details.

- Upload the required documents (see below for details).

- Complete the KYC (Know Your Customer) process by verifying your identity.

- Submit the application and wait for approval.

3. Offline Account Opening Process

- Visit the nearest Old National Bank branch.

- Request an account opening form from the customer service desk.

- Fill out the form and submit it along with the required documents.

- A bank representative will assist you with the KYC and biometric updates (if applicable).

- Once the process is complete, you will receive your account details.

Required Documents

To open an account with Old National Bank, you will need the following documents:

For Residential Customers:

- Government-issued photo ID (e.g., passport, driver’s license, or state ID).

- Social Security Number (SSN).

- Proof of address (e.g., utility bill, rental agreement, or bank statement).

For Non-Residential Customers:

- Passport or other government-issued ID.

- Visa or other proof of legal status in the USA.

- Tax Identification Number (TIN) or Individual Taxpayer Identification Number (ITIN).

- Proof of address in your home country and/or the USA.

KYC and Biometric Updates

- KYC Process: Old National Bank requires all customers to complete the KYC process to verify their identity and address. This can be done online or in person.

- Biometric Updates: Some branches may require biometric verification (fingerprint or facial recognition) for added security.

Account Opening Charges and Minimum Balance

- Account Opening Charges: Most accounts have no opening fees, but some specialized accounts may have a nominal fee.

- Minimum Balance: Varies by account type:

- Checking Accounts: 25–25–100.

- Savings Accounts: 50–50–500.

- Money Market Accounts: 1,000–1,000–2,500.

- CDs: Minimum deposit varies by term.

Interest Rates

Old National Bank offers competitive interest rates on savings accounts, money market accounts, and CDs. Here’s a general overview:

Daily Interest Rate Chart (Savings Account)

- Balance up to $1,000: 0.01% APY.

- Balance 1,000–1,000–10,000: 0.05% APY.

- Balance above $10,000: 0.10% APY.

Yearly Interest Rate Chart (CDs)

- 6-month CD: 0.50% APY.

- 1-year CD: 1.00% APY.

- 3-year CD: 1.50% APY.

- 5-year CD: 2.00% APY.

Fixed Deposit Rate Chart

- Rates vary based on the term and amount deposited. Contact the bank for the latest rates.

Senior Citizen Scheme Facilities

Old National Bank offers special benefits for senior citizens, including:

- Higher interest rates on savings accounts and CDs.

- Waived monthly maintenance fees.

- Free checks and money orders.

MIS Scheme and Insurance

- MIS Scheme: The Monthly Income Scheme provides a fixed monthly income for retirees or those seeking regular payouts.

- Insurance: Old National Bank offers life insurance, health insurance, and account protection plans.

Mobile Apps and Online Payment Methods

- Mobile App: Old National Bank’s mobile app allows you to manage your accounts, transfer funds, pay bills, and deposit checks remotely.

- Online Payment Methods: Use Zelle, PayPal, or the bank’s online bill pay feature for seamless transactions.

Customer Facilities

- 24/7 customer support via phone, email, or chat.

- Free ATM access at Old National Bank locations.

- Overdraft protection and fraud monitoring.

Bank Details

- Headquarters: Evansville, Indiana, USA.

- Customer Service: 1-800-731-2265.

- Website: www.oldnational.com.

New Updates in 2025

- Introduction of AI-powered financial planning tools.

- Enhanced mobile app features, including voice banking.

- Expanded international banking services for non-residents.

Frequently Asked Questions (FAQs)

- Can non-residents open an account with Old National Bank?

- Yes, non-residents can open an account with the required documents.

- What is the minimum balance for a savings account?

- The minimum balance ranges from 50to50to500, depending on the account type.

- Are there fees for online banking?

- No, online banking is free for all customers.

- How do I update my KYC details?

- You can update your KYC details online or by visiting a branch.

- What is the interest rate for senior citizens?

- Senior citizens enjoy higher interest rates, typically 0.25%–0.50% above standard rates.