Open a Student Account with EverBank USA 2025: A Step-by-Step Guide

Opening a student account is a great way to manage your finances while pursuing your education. EverBank USA offers a range of student-friendly banking solutions designed to meet the needs of students. Whether you prefer online or offline banking, this guide will walk you through the entire process of opening a student account with EverBank USA, including required documents, account types, fees, interest rates, and more.

Open a Student Account with EverBank USA 2025

1. Online System

EverBank USA offers a seamless online account opening process for students. Here’s how to get started:

- Visit the Official Website: Go to EverBank USA’s Website and navigate to the “Student Account” section.

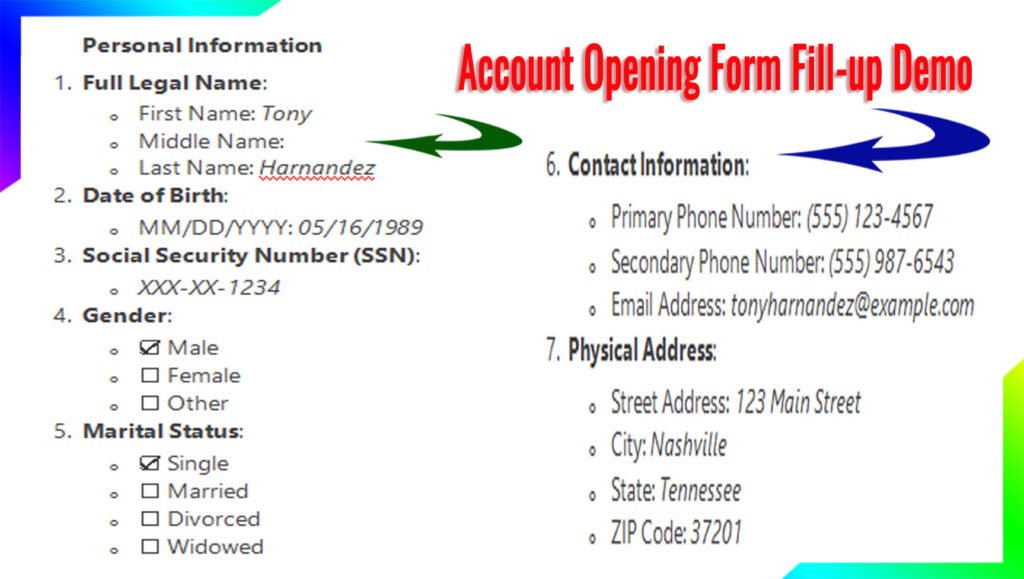

- Fill Out the Application Form: Provide your personal details, such as name, address, date of birth, and Social Security Number (SSN).

- Upload Required Documents: Submit scanned copies of the required documents (listed below).

- Complete KYC and Biometric Verification: Follow the on-screen instructions to complete the Know Your Customer (KYC) process and biometric verification (if applicable).

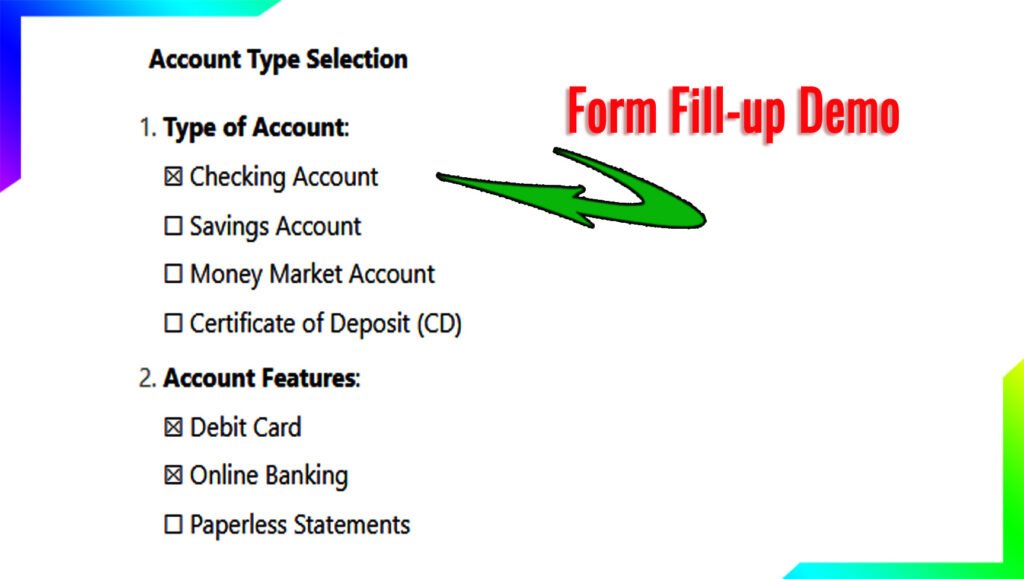

- Choose Your Account Type: Select the type of student account that suits your needs.

- Review and Submit: Double-check your application and submit it.

- Account Activation: Once approved, you’ll receive your account details via email or SMS. You can then activate your account and start banking online.

2. Offline System

If you prefer visiting a branch, follow these steps:

- Locate a Branch: Find the nearest EverBank USA branch using the branch locator on their website.

- Visit the Branch: Go to the branch with all the required documents.

- Fill Out the Application Form: Request a student account application form and fill it out.

- Submit Documents: Provide the necessary documents to the bank representative.

- Complete KYC and Biometric Verification: The bank will verify your identity and complete the KYC process.

- Account Activation: Once your application is processed, you’ll receive your account details and can start using your account.

Required Documents

To open a student account, you’ll need the following documents:

- Valid government-issued ID (e.g., passport, driver’s license, or state ID).

- Proof of address (e.g., utility bill, rental agreement, or bank statement).

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Proof of student status (e.g., student ID, enrollment letter, or tuition receipt).

KYC and Biometric Updates

EverBank USA requires all customers to complete the KYC process to comply with regulatory requirements. This involves verifying your identity and address. Additionally, biometric updates (such as fingerprint or facial recognition) may be required for enhanced security.

Account Types

EverBank USA offers the following student account options:

- Basic Student Checking Account: No minimum balance requirement, free debit card, and access to online banking.

- Student Savings Account: Earn daily interest on your savings with no monthly maintenance fees.

- Student Fixed Deposit Account: Lock in your savings for a fixed term and earn higher interest rates.

Account Opening Charges

- Student Checking Account: No account opening fee.

- Student Savings Account: No account opening fee.

- Fixed Deposit Account: No account opening fee.

Minimum Balance Requirements

- Student Checking Account: $0 minimum balance.

- Student Savings Account: $25 minimum balance.

- Fixed Deposit Account: $500 minimum deposit.

Interest Rates

EverBank USA offers competitive interest rates for student accounts. Here’s a breakdown:

Daily Interest Rate Chart (Savings Account)

| Balance Range | Daily Interest Rate |

|---|---|

| 0−0−1,000 | 0.01% |

| 1,001−1,001−5,000 | 0.05% |

| $5,001 and above | 0.10% |

Yearly Interest Rate Chart (Savings Account)

| Balance Range | Annual Interest Rate |

|---|---|

| 0−0−1,000 | 0.50% |

| 1,001−1,001−5,000 | 1.00% |

| $5,001 and above | 1.50% |

Fixed Deposit Rate Chart

| Tenure | Interest Rate |

|---|---|

| 6 months | 2.00% |

| 1 year | 2.50% |

| 2 years | 3.00% |

MIS Scheme

EverBank USA offers a Monthly Income Scheme (MIS) for students who want to earn a fixed monthly income from their savings. The interest rate for the MIS scheme is 3.5% per annum.

Insurance

EverBank USA provides free accidental insurance coverage up to $10,000 for student account holders.

Mobile Apps

EverBank USA’s mobile app is available for both iOS and Android devices. Features include:

- Account balance check.

- Fund transfers.

- Bill payments.

- Mobile check deposit.

- Transaction history.

Online Payment Methods

EverBank USA supports various online payment methods, including:

- Debit card payments.

- Online bill pay.

- Peer-to-peer (P2P) transfers.

- ACH transfers.

Customer Facilities

- 24/7 customer support via phone, email, and live chat.

- Free ATM access at EverBank USA ATMs nationwide.

- Overdraft protection for student checking accounts.

New Updates in 2025

EverBank USA is introducing the following updates in 2025:

- Enhanced mobile app with AI-powered financial insights.

- Higher interest rates for student savings accounts.

- New rewards program for student account holders.

- Expanded branch network across the USA.

FAQ

1. Can international students open an account with EverBank USA?

Yes, international students can open an account with a valid passport, student visa, and proof of enrollment.

2. Is there a fee for online banking?

No, EverBank USA offers free online banking for all student account holders.

3. Can I upgrade my student account after graduation?

Yes, you can upgrade to a regular account after providing proof of graduation.

4. How do I update my KYC details?

You can update your KYC details online through the mobile app or by visiting a branch.

5. What is the daily withdrawal limit for student accounts?

The daily withdrawal limit is $500 for student checking accounts.