Opening a bank account in the United States as a foreigner can seem daunting, but with the right information and preparation, the process can be smooth and straightforward. Zions Bank, a reputable financial institution in the USA, offers a range of services tailored to meet the needs of both domestic and international customers. This guide we’ll walk you through the step-by-step process of opening an account with Zions Bank as a foreigner, covering everything from required documents to online and offline processes, account types, fees, and more.

About Zions Bank

Zions Bank is a regional bank headquartered in Salt Lake City, Utah, with over 150 years of experience in the banking industry. It provides a wide range of financial services, including personal and business banking, loans, investment services, and more. Zions Bank is known for its customer-centric approach and innovative banking solutions, making it a popular choice for foreigners looking to open a bank account in the USA.

Step-by-Step Guide to Opening an Account

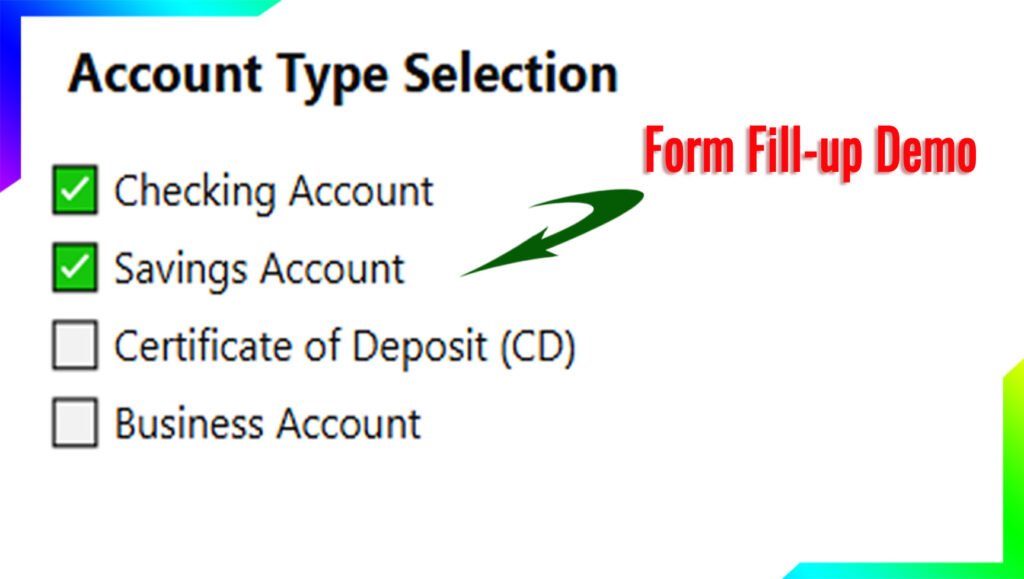

1. Choose the Right Account Type

Zions Bank offers several account types to suit different needs. As a foreigner, you can choose from:

- Checking Account: For everyday transactions.

- Savings Account: To earn interest on your deposits.

- Fixed Deposit Account: For long-term savings with higher interest rates.

- Senior Citizen Schemes: Special accounts with additional benefits for seniors.

- MIS (Monthly Income Scheme): Provides a fixed monthly income.

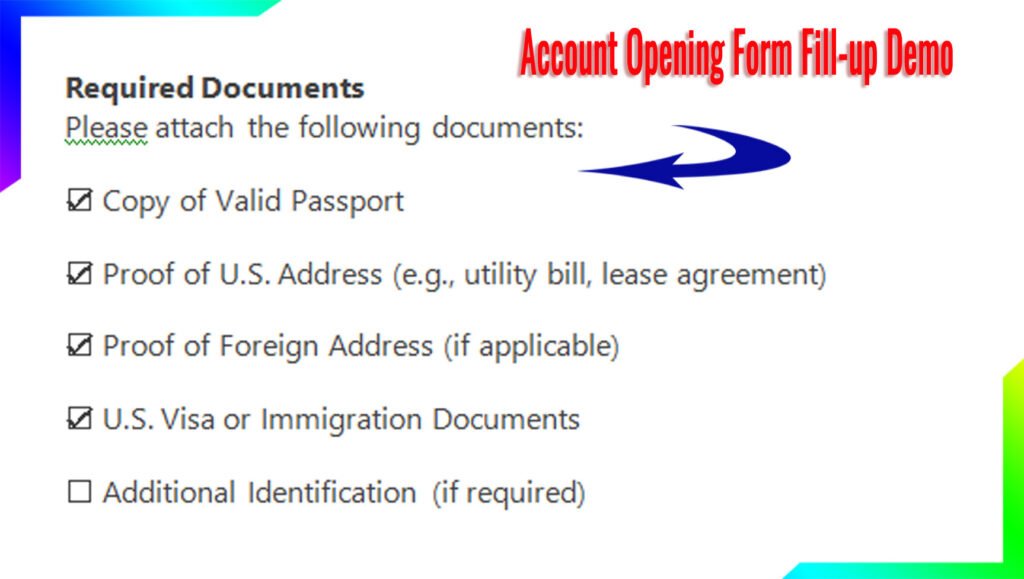

2. Gather Required Documents

To open an account, you’ll need to provide the following documents:

- Passport: A valid passport as proof of identity.

- Visa: Proof of legal status in the USA (e.g., student visa, work visa, or green card).

- Proof of Address: Utility bills, rental agreements, or bank statements from your home country.

- Tax Identification Number (TIN): If applicable.

- Initial Deposit: The minimum amount required to open the account.

3. Visit a Zions Bank Branch (Offline Process)

If you prefer to open your account in person:

- Locate the nearest Zions Bank branch using their branch locator tool.

- Schedule an appointment or walk in with your documents.

- Meet with a bank representative who will guide you through the account opening process.

- Complete the KYC (Know Your Customer) process by submitting your documents and providing biometric data (if required).

- Deposit the minimum required amount to activate your account.

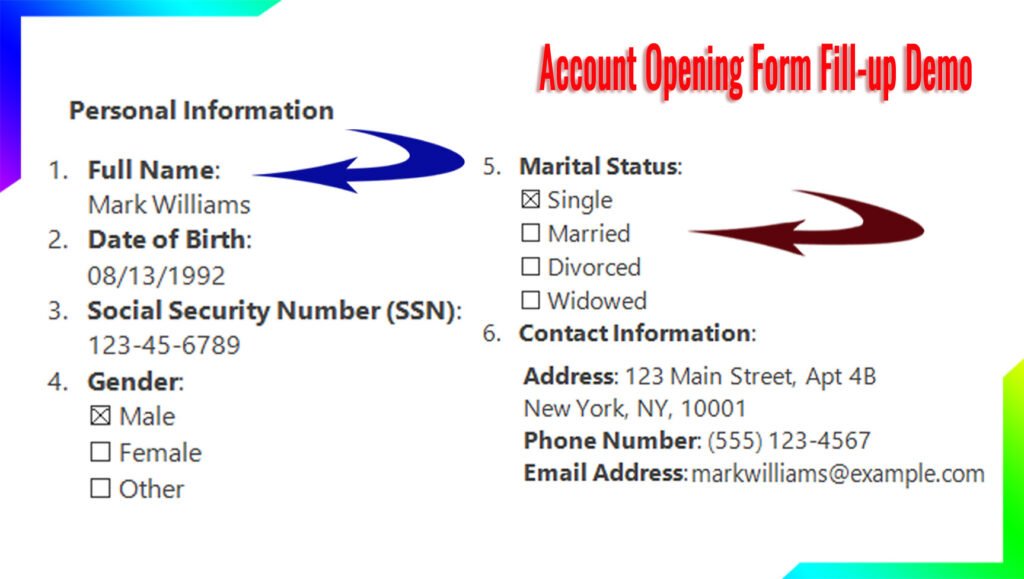

4. Online Account Opening Process

Zions Bank also offers an online account opening option for added convenience:

- Visit the official Zions Bank website.

- Select the type of account you wish to open.

- Fill out the online application form with your personal and financial details.

- Upload scanned copies of your required documents.

- Complete the e-KYC process by verifying your identity through a video call or digital submission.

- Fund your account using a wire transfer or other accepted methods.

Key Features and Charges

Account Opening Charges

- Most personal accounts have no opening fees, but some specialized accounts may require a nominal fee.

Minimum Balance Requirements

- Checking Account: 50–50–100 (varies by account type).

- Savings Account: 25–25–100.

- Fixed Deposit: Varies based on the deposit term.

Interest Rates

- Daily Interest Rate: Calculated on your daily balance for savings accounts.

- Yearly Interest Rate: Typically ranges from 0.01% to 0.05% for savings accounts.

- Fixed Deposit Rates: Varies by term (e.g., 1-year FD may offer 1.5%–2.5% interest).

Senior Citizen Schemes

- Higher interest rates on savings and fixed deposits.

- Special discounts on banking services.

MIS (Monthly Income Scheme)

- Earn a fixed monthly income with competitive interest rates.

Additional Services and Facilities

Insurance

Zions Bank offers various insurance products, including life, health, and property insurance, to protect your financial future.

Mobile Apps and Online Payment Methods

- Zions Bank Mobile App: Manage your account, transfer funds, pay bills, and more.

- Online Payment Methods: Zelle, ACH transfers, wire transfers, and bill pay services.

Customer Facilities

- 24/7 customer support via phone, email, and chat.

- Access to over 400 ATMs across the USA.

- Free financial planning and investment advice.

New Updates in 2025

Zions Bank is continuously evolving to meet customer needs. In 2025, expect:

- Enhanced digital banking features, including AI-driven financial insights.

- Expanded international banking services for foreigners.

- Lower fees and higher interest rates on select accounts.

FAQ

1. Can I open a Zions Bank account without a Social Security Number (SSN)?

Yes, Zions Bank allows foreigners to open accounts without an SSN. You’ll need to provide an ITIN (Individual Taxpayer Identification Number) or other valid identification.

2. What is the minimum deposit required to open an account?

The minimum deposit varies by account type but typically ranges from 25to25to100.

3. Can I open an account online if I’m not in the USA?

Yes, Zions Bank offers online account opening for foreigners, but you may need to visit a branch to complete the KYC process.

4. Are there any fees for maintaining the account?

Some accounts may have monthly maintenance fees, but these can often be waived by maintaining a minimum balance or setting up direct deposit.

5. How long does it take to open an account?

The process can take as little as 15–30 minutes online or in-branch, provided you have all the required documents.