CIBC Bank USA offers a range of banking solutions suited for local and non-resident needs. Should you wish to open an account, this guide will walk you through the process, required papers, account types, fees, interest rates, and extra banking services.

Step by Step Account Opening Process

1. Choose Your Account Type

CIBC Bank USA offers different account types, including:

- Checking Account

- Savings Account

- Fixed Deposit Account

- Money Market Account

- Senior Citizen Schemes

- Monthly Income Scheme (MIS)

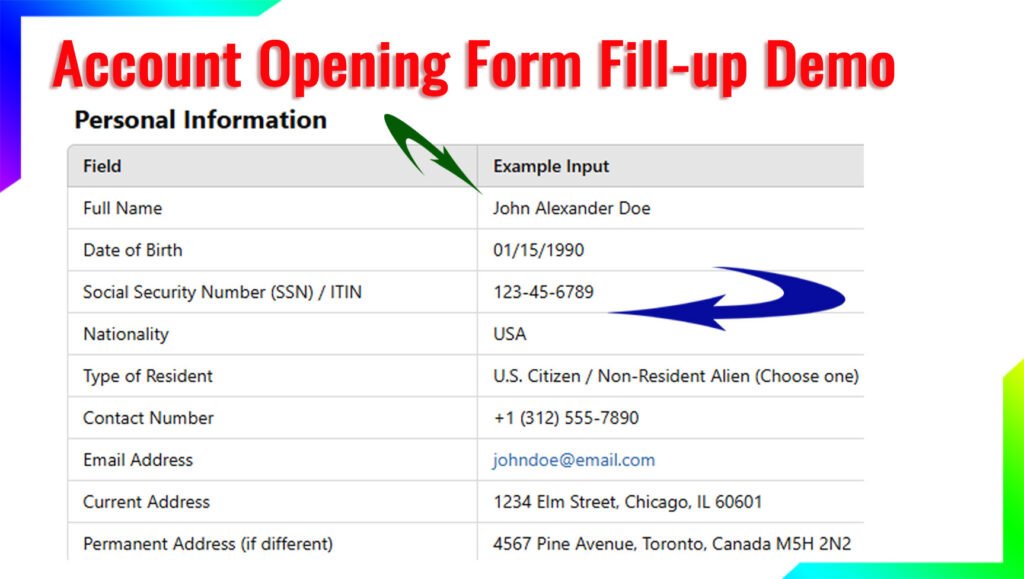

2. Gather Required Documents

To open an account, you need the following documents:

- For Residents:

- Government-issued ID (Driver’s license, Passport, or State ID)

- Social Security Number (SSN)

- Proof of Address (Utility bill, Lease Agreement, or Bank statement)

- Initial Deposit Amount

- For Non-Residents:

- Valid Passport

- U.S. Visa or Immigration Documents

- Foreign Address Proof

- Tax Identification Number (TIN) or ITIN

- U.S. Contact Information

- Initial Deposit Amount

3. Apply Online or Visit a Branch

You can open an account by visiting a nearby branch or through the CIBC Bank USA website. Online applications require uploading scanned documents and completing the Know Your Customer (KYC) process.

4. KYC & Biometric Updates

CIBC Bank USA ensures compliance with regulatory requirements through:

- KYC Updates: Verification of identity and address through periodic updates.

- Biometric Updates: Some accounts require biometric verification such as fingerprint or facial recognition.

5. Fund Your Account

Once your application is approved, you must fund your account with the minimum required balance. This can be done via:

- Online transfer

- Wire transfer

- Cash deposit at a branch

- Check deposit

Account Opening Charges & Minimum Balance

| Account Type | Opening Charges | Minimum Balance Requirement |

|---|---|---|

| Checking Account | $0 – $25 | $500 – $1,000 |

| Savings Account | $0 – $25 | $100 – $500 |

| Fixed Deposit | $0 | $1,000+ |

| Money Market | $0 – $25 | $2,500+ |

Interest Rate Charts

Daily Interest Rate Chart (Approximate)

| Account Type | Interest Rate (Daily) |

| Savings Account | 0.01% – 0.03% |

| Money Market | 0.02% – 0.05% |

Yearly Interest Rate Chart (Approximate)

| Account Type | Interest Rate (Yearly) |

| Savings Account | 0.10% – 0.50% |

| Fixed Deposit | 1.5% – 4.0% |

| Money Market | 0.20% – 1.00% |

Fixed Deposit Interest Rate Chart

| Tenure | Interest Rate (Yearly) |

| 6 Months | 1.75% – 2.25% |

| 1 Year | 2.50% – 3.00% |

| 3 Years | 3.50% – 4.00% |

| 5 Years | 4.00% – 4.50% |

Senior Citizen Scheme Facilities

- Higher interest rates on fixed deposits.

- Priority banking services.

- Special loan offers.

- Personalized financial planning.

Monthly Income Scheme (MIS)

- Provides fixed monthly payouts on deposits.

- Interest rate varies based on deposit tenure.

- Ideal for retirees and those seeking a steady income stream.

Insurance & Protection Services

- Life Insurance Plans

- Health Insurance Coverage

- Travel Insurance

- Home and Auto Insurance Bundles

Mobile Apps & Online Payment Methods

- CIBC Mobile Banking App for managing accounts, transactions, and bill payments.

- Online banking portal for fund transfers and check deposits.

- Payment methods include:

- ACH Transfers

- Wire Transfers

- Zelle

- PayPal Integration

- Debit & Credit Card Payments

Customer Facilities & Bank Details

- 24/7 Customer Support

- Dedicated Relationship Managers

- Multi-currency Accounts for International Clients

- Wealth Management & Investment Services

- ATM & Branch Access Across the U.S.

New Updates in 2025

- Enhanced AI-based customer support.

- Expanded digital banking features.

- Increased interest rates on long-term deposits.

- Biometric security enhancements.

Frequently Asked Questions (FAQ)

1. Can non-residents open an account with CIBC Bank USA?

Yes, non-residents can open an account with a valid passport, visa, and proof of address.

2. What is the minimum deposit required for a savings account?

The minimum deposit varies but typically ranges from $100 to $500.

3. Does CIBC Bank USA offer online banking for non-residents?

Yes, non-residents can access online banking services once their account is verified.

4. How long does the account opening process take?

For residents, it takes 1-3 business days. For non-residents, it may take up to 7 business days due to additional verification.

5. Is there a fee for closing an account early?

Yes, closing an account within 90 days may incur a fee, typically around $25.