Opening a bank account in the United States as a non-resident can be a complex process, but with the right guidance, it becomes manageable. Webster Bank offers a range of personal banking solutions, and while their services are primarily tailored for U.S. residents, international clients may still have options. Here’s a step-by-step guide to help you navigate the process:

Step 1: Choose the Right Account Type

Webster Bank offers various account types to suit different needs. As a foreigner, you can choose from:

- Checking Account: For everyday transactions.

- Savings Account: To earn interest on your deposits.

- Fixed Deposit Account: For higher interest rates on locked-in funds.

- Senior Citizen Schemes: Special accounts with additional benefits for seniors.

- MIS (Monthly Income Scheme): Regular income through monthly interest payouts.

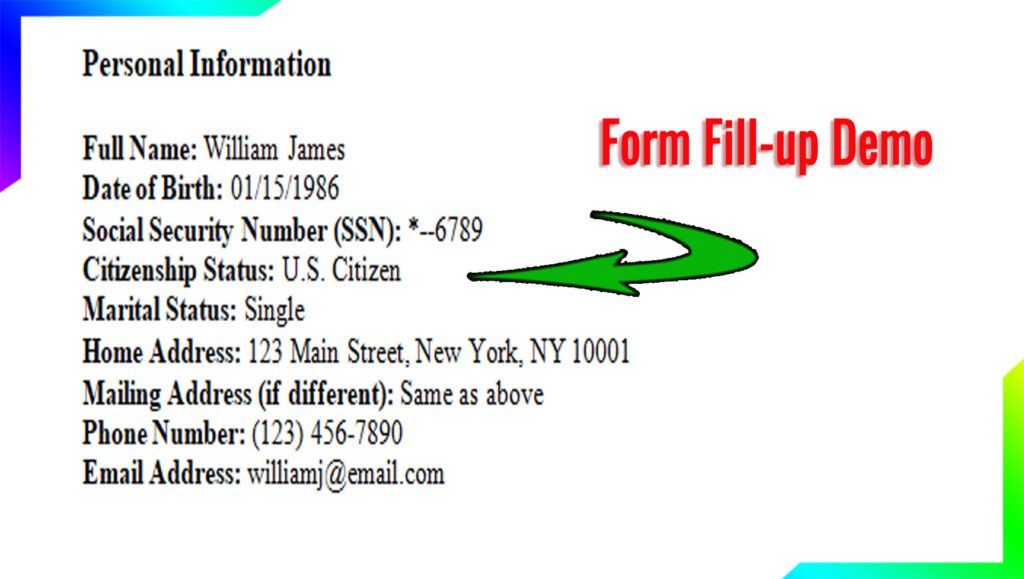

Step 2: Gather Required Documents

To open an account, you’ll need to provide the following documents:

- Passport: A valid passport for identity verification.

- Visa: Proof of your legal status in the USA (e.g., student visa, work visa, or tourist visa).

- Proof of Address: A utility bill, rental agreement, or bank statement from your home country.

- ITIN (Individual Taxpayer Identification Number): If you don’t have a Social Security Number (SSN), you’ll need an ITIN.

- Initial Deposit: Some accounts require a minimum deposit to activate.

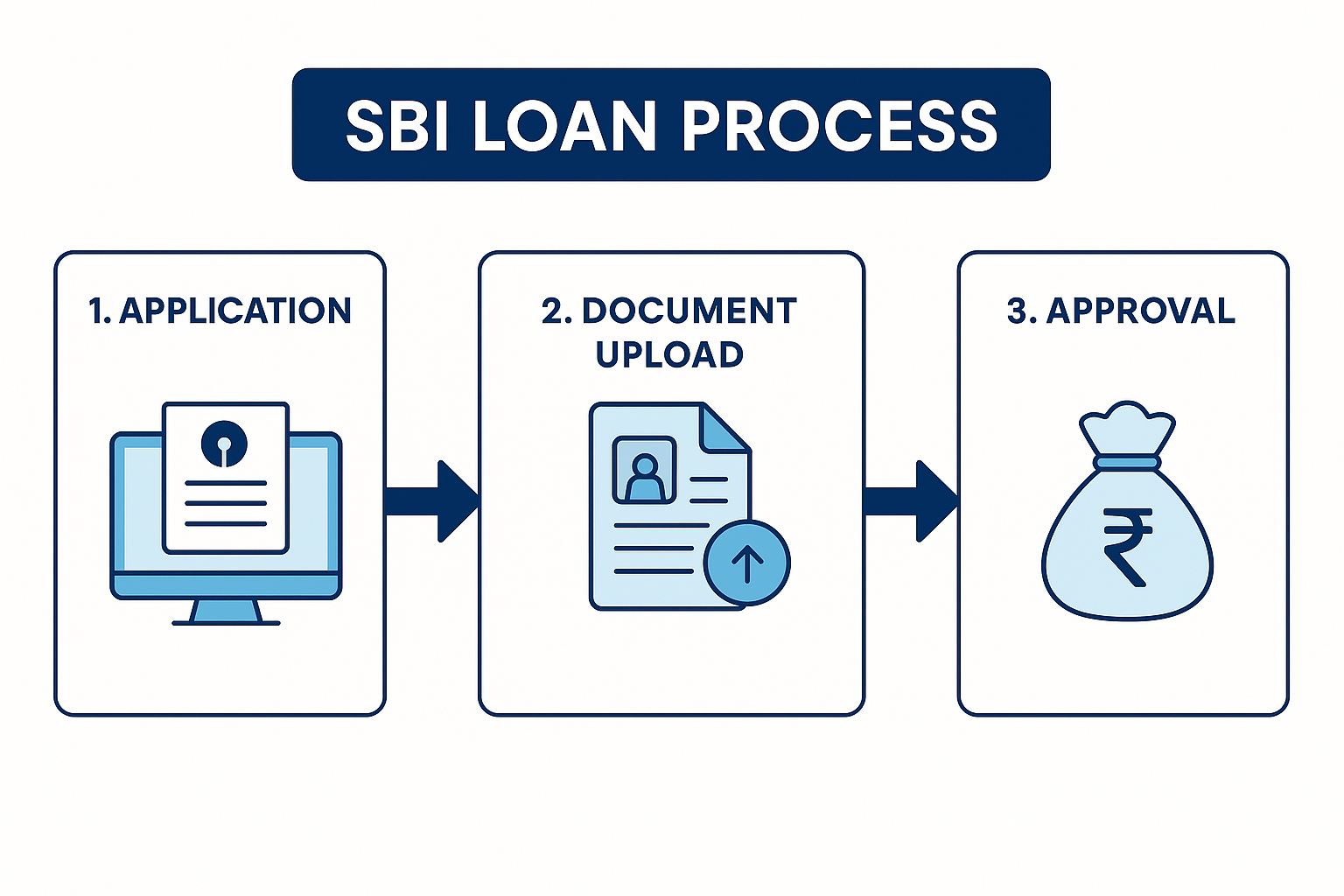

Step 3: Visit a Webster Bank Branch or Apply Online

- In-Person: Visit the nearest Webster Bank branch with your documents. A bank representative will guide you through the process.

- Online Application: Webster Bank’s online system allows you to start the process digitally. Visit their official website and follow the instructions.

Step 4: Complete KYC and Biometric Updates

Webster Bank follows strict KYC (Know Your Customer) norms. You’ll need to:

- Provide biometric data (fingerprints and photograph) at the branch.

- Verify your identity through video KYC if applying online.

Step 5: Fund Your Account

Once your account is approved, you’ll need to deposit the minimum required amount. This varies by account type:

- Checking Account: 50–50–100 minimum balance.

- Savings Account: 100–100–500 minimum balance.

- Fixed Deposit: Varies based on the term and amount.

Webster Bank Account Features and Charges

Account Opening Charges

- Most accounts have no opening fees, but some specialized accounts may charge a nominal fee.

Minimum Balance Requirements

- Checking Account: 50–50–100.

- Savings Account: 100–100–500.

- Fixed Deposit: No minimum balance, but a lump sum is required.

Interest Rates

Webster Bank offers competitive interest rates. Here’s a quick overview:

| Account Type | Daily Interest Rate | Yearly Interest Rate |

|---|---|---|

| Savings Account | 0.01%–0.05% | 0.50%–1.50% |

| Fixed Deposit (1 Year) | 0.02%–0.08% | 2.00%–3.50% |

| Senior Citizen Scheme | 0.03%–0.10% | 3.00%–4.00% |

Fixed Deposit Rates (2025 Update)

Webster Bank’s fixed deposit rates are updated annually. As of 2025, the rates are:

| Term | Interest Rate |

|---|---|

| 6 Months | 2.50% |

| 1 Year | 3.00% |

| 2 Years | 3.50% |

| 5 Years | 4.00% |

Special Schemes and Facilities

Senior Citizen Schemes

- Higher interest rates on savings and fixed deposits.

- Dedicated customer support.

- Free insurance coverage up to $10,000.

MIS (Monthly Income Scheme)

- Earn monthly interest payouts.

- Flexible tenures ranging from 1 to 5 years.

Insurance Facilities

Webster Bank offers insurance products, including:

- Life insurance.

- Health insurance.

- Accidental coverage.

Digital Banking and Mobile Apps

Webster Bank Mobile App

- Features: Account management, fund transfers, bill payments, and more.

- Availability: iOS and Android.

Online Payment Methods

- ACH Transfers: For domestic payments.

- Wire Transfers: For international transfers.

- Bill Pay: Pay utilities and other bills directly through the app.

Customer Facilities

- 24/7 customer support via phone, email, and chat.

- Free ATM access at Webster Bank branches.

- Overdraft protection for checking accounts.

New Updates in 2025

- Enhanced Mobile App: New features like budgeting tools and spending insights.

- Higher FD Rates: Increased interest rates for fixed deposits.

- Green Banking: Eco-friendly initiatives, including paperless statements and carbon-neutral transactions.

FAQs

1. Can I open a Webster Bank account without an SSN?

Yes, you can use an ITIN (Individual Taxpayer Identification Number) instead of an SSN.

2. What is the minimum balance for a savings account?

The minimum balance ranges from 100to100to500, depending on the account type.

3. Can I open an account online?

Yes, Webster Bank offers an online account opening process for non-residents.

4. Are there fees for international transfers?

Yes, international wire transfers may incur a fee of 25–25–50.

5. What is the interest rate for senior citizens?

Senior citizens enjoy higher interest rates, typically 0.5%–1% above standard rates.