Opening a bank account in the USA can be a seamless process if you have the right information. Comerica Bank, one of the leading financial institutions in the United States, offers a variety of account options for both residential and non-residential customers. Whether you’re a U.S. resident or an international customer, this guide will walk you through the entire process of opening an account with Comerica Bank, including online systems, required documents, KYC updates, and more.

Step-by-Step Process to Open an Account with Comerica Bank

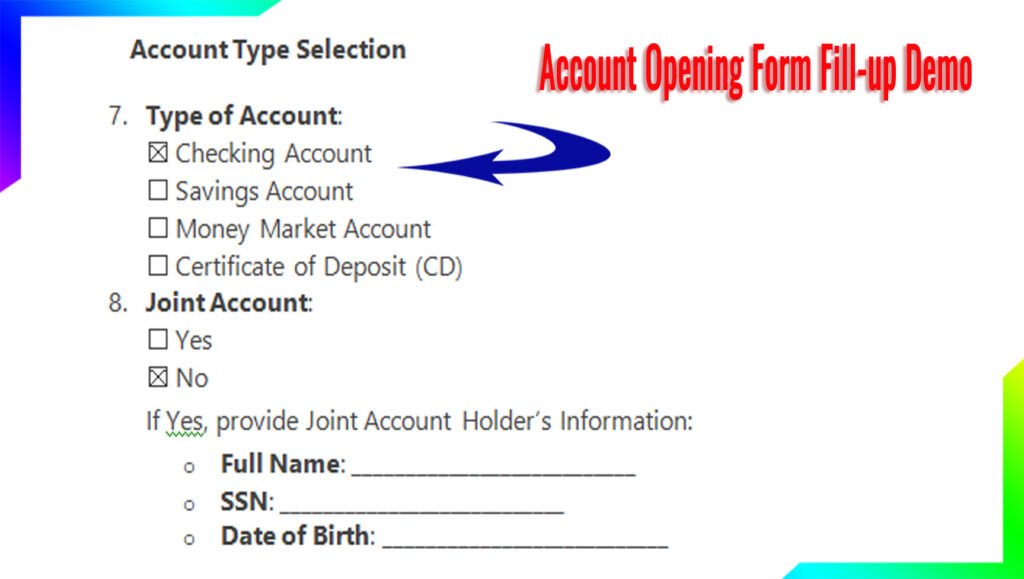

1. Choose the Right Account Type

Comerica Bank offers a range of account types to suit different needs:

- Checking Accounts: For everyday transactions.

- Savings Accounts: To grow your savings with interest.

- Money Market Accounts: Higher interest rates with check-writing privileges.

- Certificates of Deposit (CDs): Fixed-term deposits with guaranteed returns.

- Business Accounts: For entrepreneurs and businesses.

- International Accounts: For non-residents.

2. Gather Required Documents

To open an account, you’ll need the following documents:

- For Residential Customers:

- Government-issued ID (e.g., passport, driver’s license).

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Proof of address (utility bill, lease agreement, etc.).

- For Non-Residential Customers:

- Passport or foreign government-issued ID.

- Proof of address in your home country.

- Visa or other immigration documents (if applicable).

- Tax Identification Number (TIN) from your home country.

3. Visit a Branch or Apply Online

- In-Person: Visit the nearest Comerica Bank branch with your documents. A representative will guide you through the process.

- Online: Go to Comerica Bank’s official website and click on “Open an Account.” Fill out the application form and upload scanned copies of your documents.

4. Complete KYC and Biometric Updates

- Comerica Bank follows strict KYC (Know Your Customer) norms. You may need to provide additional information or documents for verification.

- Biometric updates, such as fingerprint scanning, may be required for enhanced security.

5. Pay Account Opening Charges

- Comerica Bank may charge a nominal fee for opening certain types of accounts. Check the latest fee structure on their website.

6. Maintain the Minimum Balance

- Each account type has a minimum balance requirement. For example:

- Checking Accounts: 50–50–100.

- Savings Accounts: 100–100–500.

- Money Market Accounts: 1,000–1,000–2,500.

Comerica Bank Account Features

Interest Rates

- Daily Interest Rate: Varies based on account type and balance.

- Yearly Interest Rate: Typically ranges from 0.01% to 0.05% for savings accounts.

- Fixed Deposit Rates: Check the latest FD rates on Comerica’s website or app.

Senior Citizen Schemes

- Comerica offers special interest rates and benefits for senior citizens, including higher FD rates and waived fees.

MIS Scheme

- Monthly Income Schemes (MIS) are available for customers looking for regular payouts.

Insurance

- Comerica provides optional insurance products, including life insurance and deposit insurance.

Digital Banking with Comerica

Mobile App

- Comerica’s mobile app allows you to:

- Check account balances.

- Transfer funds.

- Pay bills.

- Deposit checks remotely.

- Manage investments.

Online Payment Methods

- Comerica supports online payments through:

- Zelle.

- ACH transfers.

- Wire transfers.

- Bill pay services.

Customer Facilities

- 24/7 customer support via phone, email, and chat.

- Access to over 400 branches and 1,000+ ATMs across the USA.

- Financial planning and investment advisory services.

New Updates in 2025

- Enhanced mobile app features, including AI-driven financial insights.

- Introduction of cryptocurrency investment options.

- Expanded international banking services for non-residents.

FAQ

1. Can non-residents open an account with Comerica Bank?

Yes, non-residents can open an account with the required documents.

2. What is the minimum balance for a savings account?

The minimum balance ranges from 100to100to500, depending on the account type.

3. Are there fees for online banking?

No, Comerica Bank offers free online and mobile banking services.

4. How long does it take to open an account?

The process typically takes 1–2 business days for online applications and immediate activation for in-branch applications.

5. Does Comerica Bank offer insurance?

Yes, Comerica provides optional insurance products for account holders.1. Can non-residents open an account with Comerica Bank?

Yes, non-residents can open an account with the required documents.

2. What is the minimum balance for a savings account?

The minimum balance ranges from 100to100to500, depending on the account type.

3. Are there fees for online banking?

No, Comerica Bank offers free online and mobile banking services.

4. How long does it take to open an account?

The process typically takes 1–2 business days for online applications and immediate activation for in-branch applications.

5. Does Comerica Bank offer insurance?

Yes, Comerica provides optional insurance products for account holders.1. Can non-residents open an account with Comerica Bank?

Yes, non-residents can open an account with the required documents.

2. What is the minimum balance for a savings account?

The minimum balance ranges from 100to100to500, depending on the account type.

3. Are there fees for online banking?

No, Comerica Bank offers free online and mobile banking services.

4. How long does it take to open an account?

The process typically takes 1–2 business days for online applications and immediate activation for in-branch applications.

5. Does Comerica Bank offer insurance?

Yes, Comerica provides optional insurance products for account holders.