How to Open an Account with Huntington Bank USA: A Step-by-Step Guide for Residential & Non-Residential Customers

How to Open an Account with Huntington Bank USA: A Step-by-Step Guide for Residential & Non-Residential Customers

Huntington Bank is one of the most trusted financial institutions in the United States, offering a wide range of banking services for both residential and non-residential customers. Whether you’re a U.S. citizen, a permanent resident, or a non-resident, opening an account with Huntington Bank is a straightforward process. This blog will guide you through the step-by-step process, required documents, account types, fees, interest rates, and more.

Step-by-Step Account Opening Process

1. Choose the Right Account Type

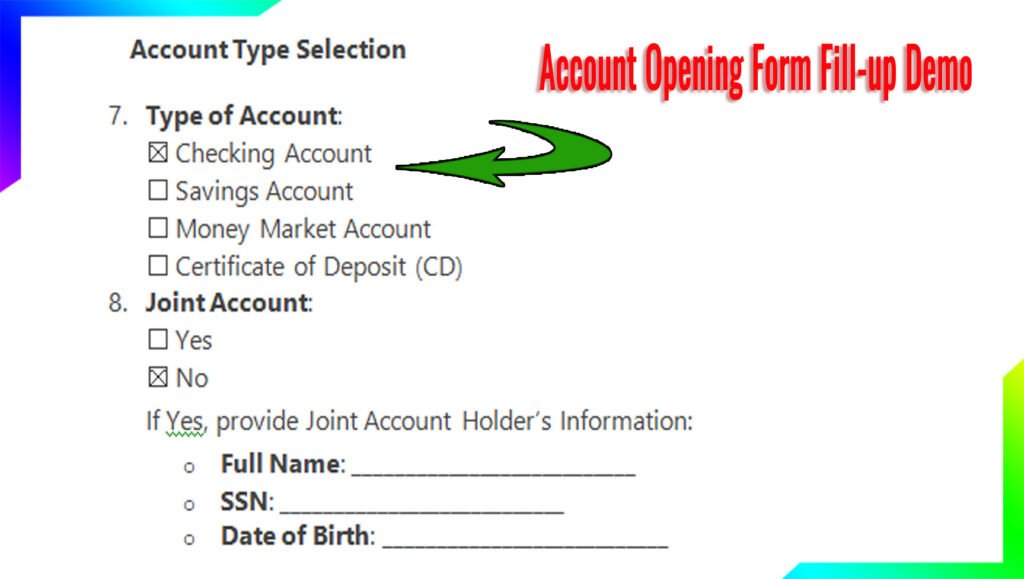

Huntington Bank offers various account types to suit your needs:

- Checking Accounts: Asterisk-Free Checking, Huntington 5 Checking, Huntington Perks Checking.

- Savings Accounts: Huntington Savings, Money Market Savings.

- Certificates of Deposit (CDs): Fixed-term deposits with competitive interest rates.

- Business Accounts: For small businesses and corporations.

- Student Accounts: Designed for college students.

2. Gather Required Documents

To open an account, you’ll need the following documents:

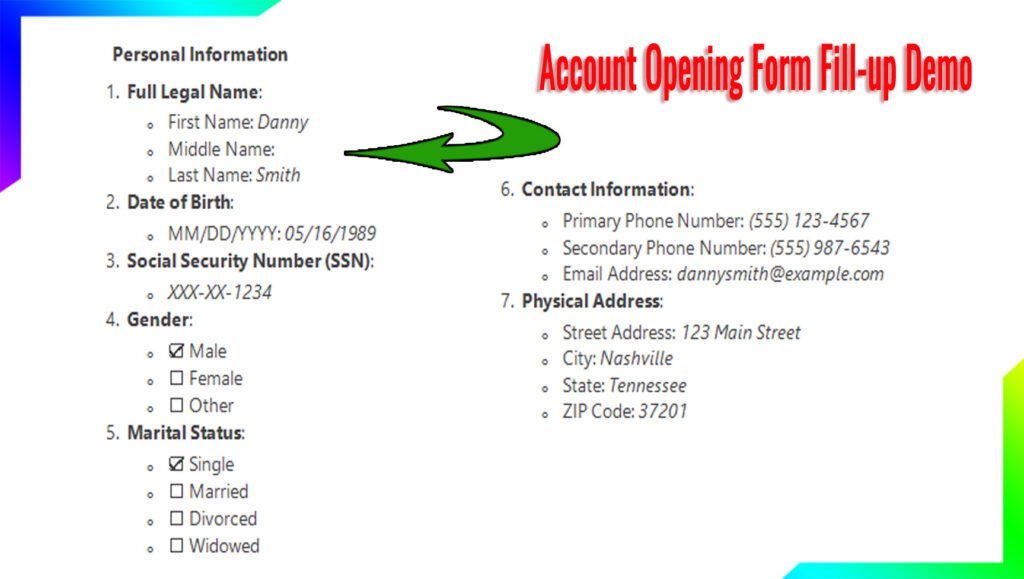

- For Residential Customers:

- Government-issued photo ID (e.g., driver’s license, passport).

- Social Security Number (SSN).

- Proof of address (utility bill, lease agreement, etc.).

- For Non-Residential Customers:

- Passport or foreign government-issued ID.

- Individual Taxpayer Identification Number (ITIN) or SSN (if applicable).

- Proof of U.S. address (if available) or foreign address.

- Visa or other immigration documents.

3. Visit a Branch or Apply Online

- Online Application:

- Visit the Huntington Bank website.

- Select the account type you want to open.

- Fill out the application form with your personal and financial details.

- Upload scanned copies of your documents.

- Submit the application and wait for approval.

- In-Person Application:

- Locate the nearest Huntington Bank branch using the branch locator on their website.

- Bring your documents and visit the branch.

- A bank representative will assist you in filling out the application.

4. Complete KYC and Biometric Updates

- Huntington Bank may require you to complete Know Your Customer (KYC) verification, which includes verifying your identity and address.

- For added security, biometric updates (e.g., fingerprint or facial recognition) may be required for online banking access.

5. Fund Your Account

- Once your account is approved, you’ll need to deposit the minimum required amount to activate it. This varies by account type (see below).

Account Opening Charges and Minimum Balance

- Account Opening Charges: Huntington Bank does not charge a fee to open most personal accounts.

- Minimum Balance Requirements:

- Checking Accounts: 0to0to5,000 (depending on the account type).

- Savings Accounts: 0to0to25.

- CDs: Varies by term and amount.

Interest Rates

Huntington Bank offers competitive interest rates on savings accounts, money market accounts, and CDs. Here’s a general overview:

Daily Interest Rate Chart (Savings Accounts)

| Account Type | Interest Rate (APY) |

|---|---|

| Huntington Savings | 0.01% – 0.05% |

| Money Market | 0.02% – 0.10% |

Yearly Interest Rate Chart (CDs)

| Term Length | Interest Rate (APY) |

|---|---|

| 6 Months | 0.10% – 0.50% |

| 12 Months | 0.20% – 0.75% |

| 24 Months | 0.30% – 1.00% |

Fixed Deposit Rate Chart

| Deposit Amount | Term Length | Interest Rate (APY) |

|---|---|---|

| $1,000+ | 6 Months | 0.10% – 0.50% |

| $5,000+ | 12 Months | 0.20% – 0.75% |

| $10,000+ | 24 Months | 0.30% – 1.00% |

Senior Citizen Scheme Facilities

Huntington Bank offers special benefits for senior citizens, including:

- Higher interest rates on savings accounts and CDs.

- Waived fees on certain accounts.

- Dedicated customer support.

MIS Scheme and Insurance

- MIS (Monthly Income Scheme): Huntington Bank does not currently offer an MIS scheme, but their CDs provide fixed returns over a specified term.

- Insurance: Huntington Bank offers various insurance products, including life, home, and auto insurance, through its partners.

Mobile Apps and Online Payment Methods

- Mobile App: The Huntington Mobile App allows you to manage your accounts, deposit checks, transfer funds, and pay bills.

- Online Payment Methods: Use Zelle, Bill Pay, or ACH transfers for seamless online payments.

Customer Facilities

- 24/7 customer support via phone, email, and chat.

- Over 1,000 ATMs and branches across the Midwest.

- Financial wellness tools and resources.

New Updates in 2025

- Introduction of AI-driven financial planning tools.

- Enhanced mobile app features, including voice banking.

- Expanded international banking services for non-residential customers.

FAQ

1. Can non-residents open an account with Huntington Bank?

Yes, non-residents can open an account with the required documents, such as a passport, ITIN, and proof of address.

2. What is the minimum balance for a Huntington Savings account?

The minimum balance is 0to0to25, depending on the account type.

3. Are there fees for online banking?

No, Huntington Bank offers free online and mobile banking services.

4. How do I update my KYC details?

You can update your KYC details online through the Huntington Mobile App or by visiting a branch.

5. What is the interest rate for senior citizens?

Senior citizens may receive higher interest rates on savings accounts and CDs. Contact the bank for specific details.