Opening a bank account in the USA as a foreigner can seem daunting, but with the right guidance, the process is straightforward. KeyBank, one of the largest banks in the United States, offers a range of services for both residents and non-residents. This guide we’ll walk you through the step-by-step process of opening a KeyBank account online & offline, including required documents, account types, fees, interest rates, and more.

Step-by-Step Process to Open a KeyBank Account for Foreigners

Step 1: Choose the Right Account Type

KeyBank offers several account types, including:

- Checking Accounts: For everyday transactions.

- Savings Accounts: To earn interest on your deposits.

- Fixed Deposit Accounts: For long-term savings with higher interest rates.

- Senior Citizen Accounts: Special accounts with additional benefits for seniors.

As a foreigner, you can open a personal checking or savings account, depending on your needs.

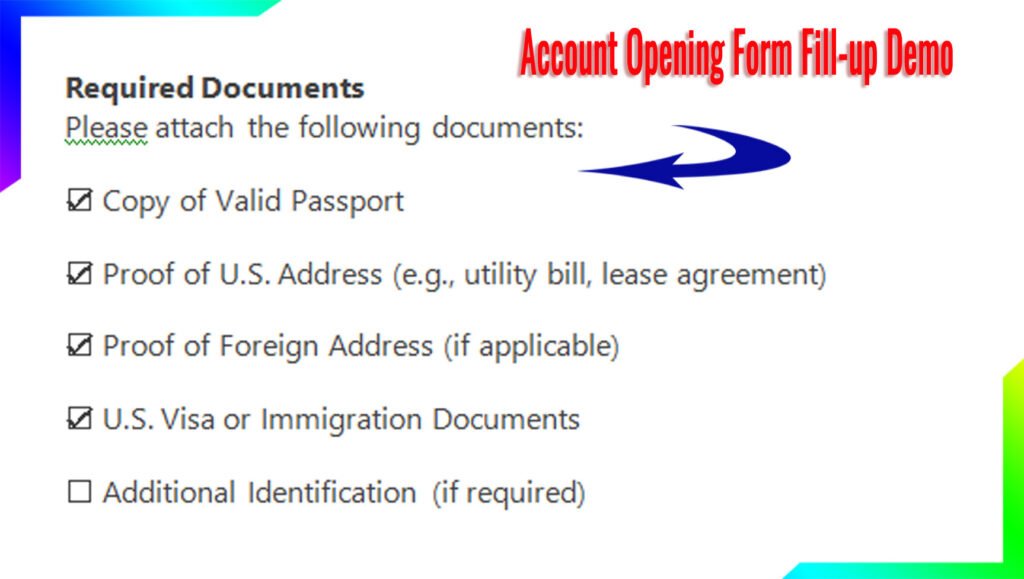

Step 2: Gather Required Documents

To open an account, you’ll need the following documents:

- Passport: A valid passport is mandatory for identification.

- Visa: Proof of your legal status in the USA (e.g., student visa, work visa, or tourist visa).

- Proof of Address: A utility bill, rental agreement, or bank statement from your home country.

- Tax Identification Number (TIN) or Individual Taxpayer Identification Number (ITIN): If you don’t have a Social Security Number (SSN), you can apply for an ITIN.

- Initial Deposit: The minimum amount required to open the account (varies by account type).

Step 3: Visit a KeyBank Branch or Apply Online

- In-Person: Visit the nearest KeyBank branch with your documents. A bank representative will guide you through the process.

- Online: KeyBank’s online account opening system allows you to start the process digitally. However, you may need to visit a branch to complete KYC (Know Your Customer) verification.

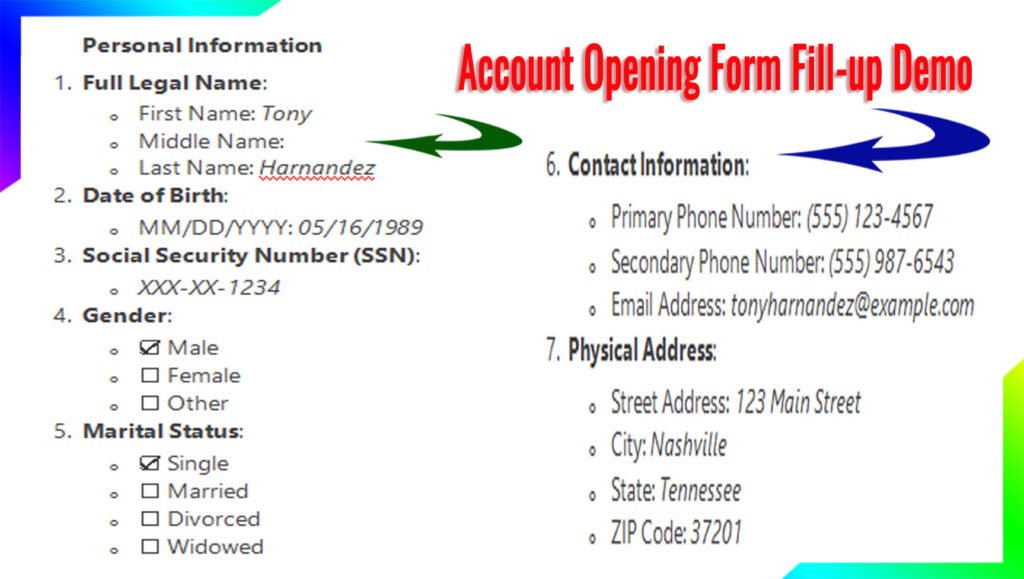

Step 4: Complete KYC and Biometric Updates

KeyBank follows strict KYC norms. You’ll need to provide:

- Biometric data (fingerprints or facial recognition) for identity verification.

- Updated personal information, including your address and contact details.

Step 5: Fund Your Account

Once your account is approved, you’ll need to deposit the minimum required amount. This varies by account type:

- Checking Account: 50–50–100 minimum deposit.

- Savings Account: 25–25–50 minimum deposit.

KeyBank Account Features and Charges

Account Opening Charges

- Most personal accounts have no opening fees, but some specialized accounts may charge a nominal fee.

Minimum Balance Requirements

- Checking Account: 0–0–500 (depending on the account type).

- Savings Account: 25–25–100.

KeyBank Interest Rates

KeyBank offers competitive interest rates on savings and fixed deposit accounts. Here’s a general overview:

| Account Type | Daily Interest Rate | Yearly Interest Rate |

|---|---|---|

| Savings Account | 0.01%–0.05% | 0.35%–0.50% |

| Fixed Deposit (1 Year) | 0.10%–0.50% | 1.50%–2.50% |

Rates are subject to change. Check KeyBank’s official website for the latest updates.

KeyBank Special Schemes and Facilities

Senior Citizen Schemes

KeyBank offers senior citizens higher interest rates on savings accounts and fixed deposits, along with discounted banking fees.

MIS (Monthly Income Scheme)

KeyBank’s MIS allows you to earn a fixed monthly income by investing a lump sum amount.

Insurance

KeyBank provides insurance options, including life insurance and deposit insurance (up to $250,000 per account through FDIC).

Digital Banking and Mobile Apps

Mobile App Features

- Balance Check: View your account balance in real-time.

- Fund Transfers: Send money domestically and internationally.

- Bill Payments: Pay utilities, credit cards, and more.

- Mobile Check Deposit: Deposit checks using your smartphone camera.

Online Payment Methods

KeyBank supports online payments through:

- Zelle

- PayPal

- Apple Pay

- Google Pay

KeyBank Customer Facilities

- 24/7 Customer Support: Call, email, or chat with KeyBank’s support team.

- ATM Access: Over 1,000 ATMs nationwide.

- Branch Services: Over 1,000 branches across the USA.

KeyBank New Updates in 2025

KeyBank is introducing several updates in 2025, including:

- Enhanced mobile app features with AI-driven financial insights.

- Lower fees for international transfers.

- New fixed deposit schemes with higher interest rates.

FAQ

1. Can I open a KeyBank account without an SSN?

Yes, you can use an ITIN (Individual Taxpayer Identification Number) instead of an SSN.

2. What is the minimum balance for a KeyBank savings account?

The minimum balance is typically 25–25–100, depending on the account type.

3. Can I open an account online as a foreigner?

Yes, but you may need to visit a branch for KYC verification.

4. Does KeyBank charge for international transfers?

Yes, fees apply for international transfers. Check the latest fee structure on their website.

5. Are KeyBank accounts FDIC-insured?

Yes, all KeyBank accounts are FDIC-insured up to $250,000 per account.