BMO Bank USA, a trusted financial institution, offers a wide range of banking services for both residential and non-residential customers. Whether you’re looking to open a savings account, checking account, or explore investment options, this guide will walk you through the entire process. From required documents to online banking features, we’ve got you covered.

Step by Step Process to Open an Account with BMO Bank USA

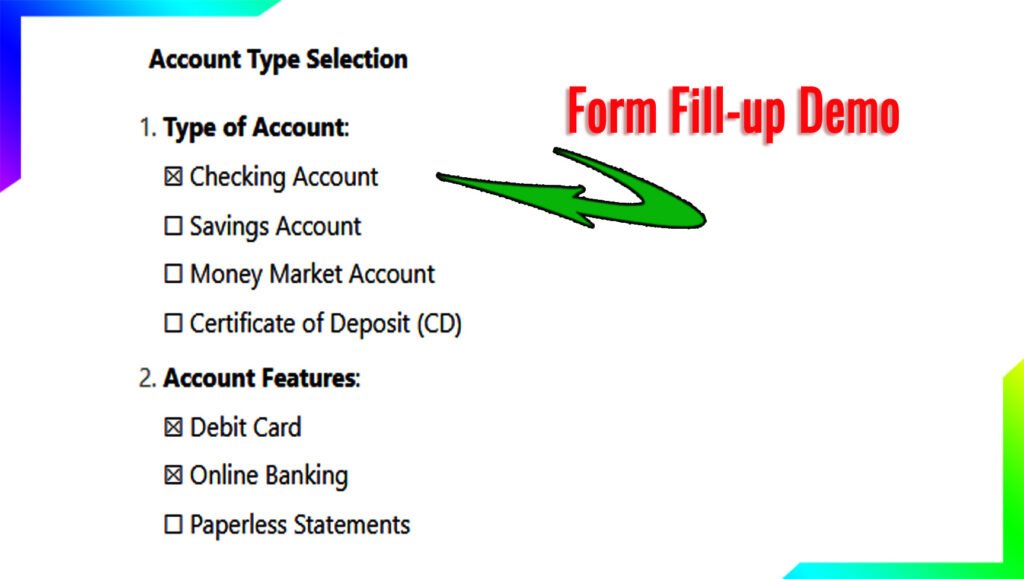

1. Choose the Right Account Type

BMO Bank USA offers various account types to suit your needs:

- Savings Account: Ideal for earning interest on your deposits.

- Checking Account: Perfect for everyday transactions.

- Fixed Deposit Account: Earn higher interest with locked-in funds.

- Senior Citizen Schemes: Special benefits for senior citizens.

- MIS (Monthly Income Scheme): Regular monthly payouts for investors.

2. Gather Required Documents

To open an account, you’ll need the following documents:

- For Residential Customers:

- Government-issued ID (Passport, Driver’s License, or State ID).

- Social Security Number (SSN).

- Proof of address (Utility bill, Lease agreement, or Bank statement).

- For Non-Residential Customers:

- Passport or Foreign Government-issued ID.

- Tax Identification Number (TIN) or equivalent.

- Proof of address in your home country.

- Visa or residency permit (if applicable).

3. Visit a Branch or Apply Online

- In-Person: Visit the nearest BMO Bank USA branch with your documents. A representative will guide you through the process.

- Online: Go to the official BMO Bank USA website and click on “Open an Account.” Fill out the application form and upload scanned copies of your documents.

4. Complete KYC (Know Your Customer) and Biometric Updates

- Submit your documents for KYC verification.

- Biometric updates (fingerprint or facial recognition) may be required for added security.

5. Pay Account Opening Charges

- Account opening fees vary depending on the account type. Check the latest fees on the BMO Bank USA website.

6. Maintain the Minimum Balance

- Each account type has a minimum balance requirement. Ensure you deposit the required amount to avoid penalties.

BMO Bank USA Account Features

Interest Rates

- Daily Interest Rate Chart: Interest is calculated daily and credited monthly.

- Yearly Interest Rate Chart: Competitive annual interest rates for savings and fixed deposits.

- Fixed Deposit Rate Chart: Higher interest rates for longer tenures.

Senior Citizen Schemes

- Special interest rates and benefits for senior citizens.

- Free insurance coverage and priority customer service.

MIS (Monthly Income Scheme)

- Earn a fixed monthly income with lump-sum investments.

- Flexible tenures and attractive interest rates.

Insurance Facilities

- Life insurance and accidental coverage options.

- Health insurance plans for account holders.

Online Banking and Mobile Apps

BMO Mobile App

- Check account balances and transaction history.

- Transfer funds, pay bills, and deposit checks remotely.

- Set up alerts for account activity.

Online Payment Methods

- Link your account to payment platforms like PayPal, Venmo, and Zelle.

- Schedule recurring payments and manage subscriptions.

Customer Facilities

- 24/7 customer support via phone, email, and live chat.

- Access to over 500 ATMs nationwide.

- Free financial planning and advisory services.

New Updates in 2025

- Introduction of AI-powered financial management tools.

- Enhanced mobile app features, including voice banking.

- Expanded rewards program for debit and credit card users.

Frequently Asked Questions (FAQs)

1. Can non-residents open an account with BMO Bank USA?

Yes, non-residents can open an account with the required documents.

2. What is the minimum balance for a savings account?

The minimum balance varies by account type. Check the latest details on the BMO Bank USA website.

3. Are there any fees for online banking?

No, online banking is free for all account holders.

4. How do I update my KYC details?

Visit a branch or update your details online through the BMO Bank USA website.

5. What is the interest rate for fixed deposits?

Interest rates vary by tenure. Refer to the fixed deposit rate chart on the BMO Bank USA website.