Opening a bank account in the USA as a foreigner can seem daunting, but with the right guidance, the process can be smooth and straightforward. Citizens Bank USA is a popular choice for many due to its wide range of services and customer-friendly policies. This guide, we’ll walk you through the step-by-step process of opening an account at Citizens Bank USA, both offline and online. We’ll also cover required documents, KYC updates, biometric updates, account types, charges, interest rates, and much more.

Table of Contents

- Offline Account Opening Process

- Online Account Opening Process

- Required Documents

- KYC and Biometric Updates

- Account Types

- Account Opening Charges and Minimum Balance

- Interest Rates

- Daily Interest Rate Chart

- Yearly Interest Rate Chart

- Fixed Deposit Rate Chart

- Senior Citizen Scheme Facilities

- MIS Scheme

- Insurance

- Mobile Apps and Online Payment Methods

- Customer Facilities

- Bank Details

- New Updates in 2025

- FAQ

1. Offline Account Opening Process

Step-by-Step Guide:

- Visit a Branch: Locate the nearest Citizens Bank USA branch. You can find the nearest branch using the bank’s website or mobile app.

- Consult a Bank Representative: Inform the representative that you are a foreigner looking to open a new account.

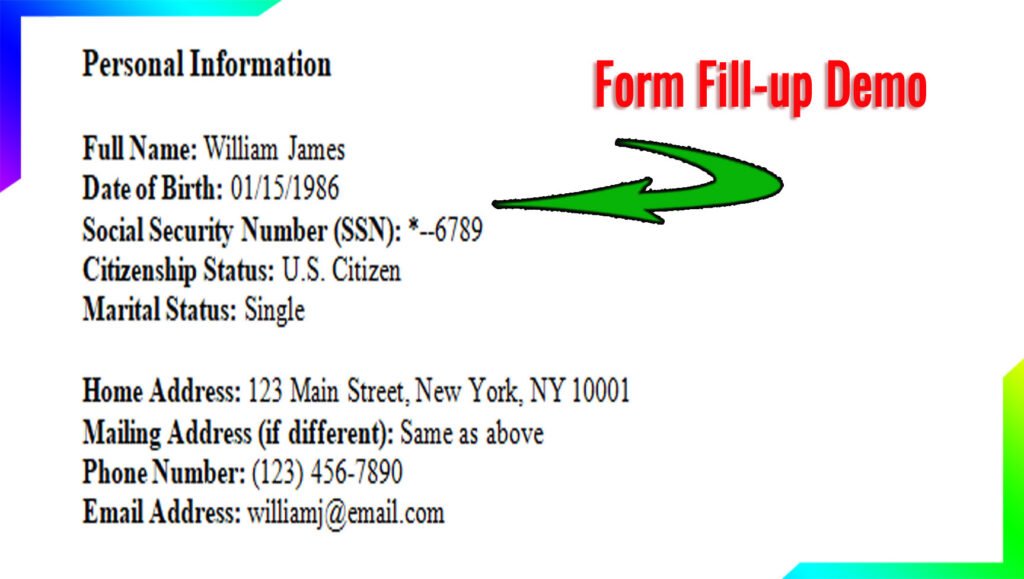

- Fill Out the Application Form: Complete the account opening form provided by the bank.

- Submit Required Documents: Provide all necessary documents (listed below).

- KYC and Biometric Verification: Undergo KYC (Know Your Customer) and biometric verification.

- Initial Deposit: Deposit the minimum required amount to activate your account.

- Receive Account Details: Once your application is approved, you will receive your account number, debit card, and other relevant details.

2. Online Account Opening Process

Step-by-Step Guide:

- Visit the Official Website: Go to the Citizens Bank USA website.

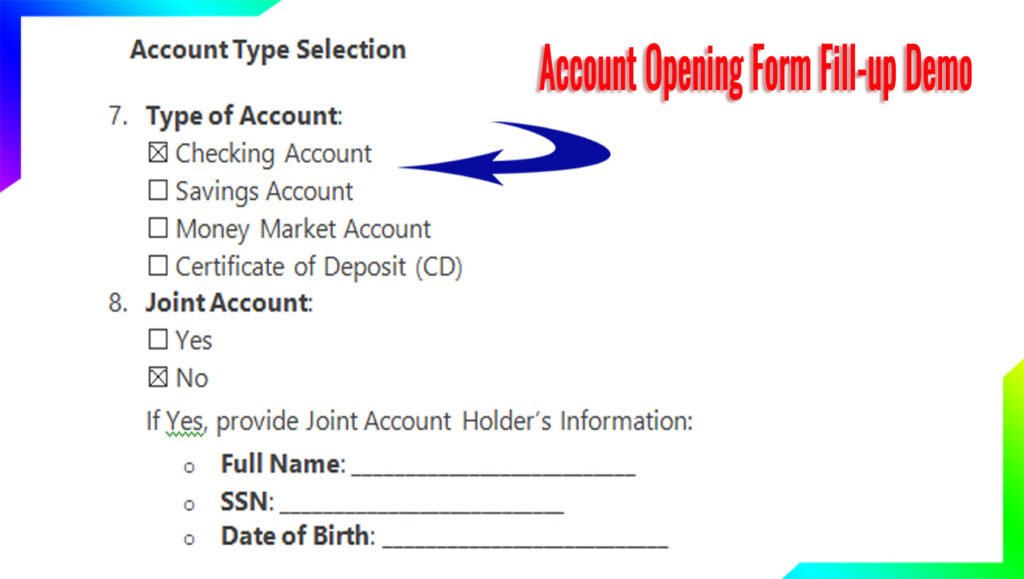

- Choose Account Type: Select the type of account you wish to open.

- Fill Out the Online Application Form: Enter all required details accurately.

- Upload Documents: Scan and upload the necessary documents.

- Video KYC: Complete the video KYC process as instructed.

- Initial Deposit: Transfer the minimum required amount via online banking or other accepted methods.

- Account Activation: Once verified, your account will be activated, and you will receive your account details via email.

3. Required Documents

- Passport: A valid passport with a visa.

- Proof of Address: Utility bills, rental agreement, or any official document with your current address.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): If applicable.

- Proof of Income: Employment letter, pay slips, or bank statements.

- Additional Identification: Any other ID as required by the bank.

4. KYC and Biometric Updates

- KYC: You will need to provide identification and address proof. This can be done in-branch or via video KYC for online applications.

- Biometric Verification: This may include fingerprint scanning and facial recognition, depending on the bank’s requirements.

5. Account Types

- Savings Account: Ideal for everyday banking.

- Checking Account: For frequent transactions.

- Fixed Deposit Account: Earn higher interest on a lump sum amount.

- Senior Citizen Account: Special benefits for senior citizens.

- NRI Account: For Non-Resident Indians.

6. Account Opening Charges and Minimum Balance

- Account Opening Charges: Typically range from 25to25to50, depending on the account type.

- Minimum Balance: Savings accounts usually require a minimum balance of 100,whilecheckingaccountsmayrequire100,whilecheckingaccountsmayrequire500.

7. Interest Rates

Daily Interest Rate Chart

| Account Type | Daily Interest Rate |

|---|---|

| Savings | 0.01% |

| Checking | 0.005% |

Yearly Interest Rate Chart

| Account Type | Yearly Interest Rate |

|---|---|

| Savings | 0.50% |

| Checking | 0.25% |

Fixed Deposit Rate Chart

| Tenure | Interest Rate |

|---|---|

| 1 Year | 1.50% |

| 2 Years | 1.75% |

| 5 Years | 2.25% |

8. Senior Citizen Scheme Facilities

- Higher Interest Rates: Senior citizens enjoy 0.50% higher interest rates on fixed deposits.

- Free Insurance: Complimentary insurance coverage up to $10,000.

- Priority Services: Dedicated customer service and priority banking.

9. MIS Scheme

Monthly Income Scheme: Earn a fixed monthly income with a lump sum investment. Interest rates range from 1.75% to 2.25% depending on the tenure.

10. Insurance

- Life Insurance: Coverage up to $50,000.

- Health Insurance: Comprehensive health insurance plans available.

11. Mobile Apps and Online Payment Methods

- Mobile App: Manage your account, transfer funds, and pay bills using the Citizens Bank USA mobile app.

- Online Payment Methods: PayPal, Google Pay, Apple Pay, and direct bank transfers.

12. Customer Facilities

- 24/7 Customer Support: Available via phone, email, and chat.

- ATM Services: Access to a wide network of ATMs across the USA.

- Online Banking: Full-featured online banking platform.

13. Bank Details

- Headquarters: Providence, Rhode Island, USA.

- Customer Service: 1-800-922-9999.

- Website: www.citizensbank.com

14. New Updates in 2025

- Enhanced Mobile App Features: New budgeting tools and financial planning features.

- Higher Interest Rates: Increased interest rates on savings and fixed deposit accounts.

- Expanded Insurance Coverage: New insurance products tailored for foreigners.

15. FAQ

Q1: Can I open an account without an SSN?

A1: Yes, you can open an account with an ITIN if you don’t have an SSN.

Q2: What is the minimum balance required?

A2: The minimum balance varies by account type but generally starts at $100 for savings accounts.

Q3: How long does it take to open an account?

A3: Online accounts can be opened in 1-2 business days, while offline accounts may take 3-5 business days.