Open a Great Western Bank Account in the USA for Foreigners 2025

Opening a bank account in the USA as a foreigner can seem daunting, but Great Western Bank makes the process straightforward. Whether you’re relocating, studying, or working in the USA, this guide will walk you through the steps to open an account, including offline and online processes, required documents, and more.

Bank Description

Great Western Bank is a trusted financial institution in the USA, offering a range of services, including savings accounts, checking accounts, fixed deposits, and loans. It caters to both residents and non-residents, making it a great choice for foreigners.

How to Open a Great Western Bank Account in the USA for Foreigners 2025

Offline Process

- Visit the nearest Great Western Bank branch.

- Speak to a customer service representative about opening an account.

- Submit the required documents (see below).

- Complete the KYC (Know Your Customer) process.

- Provide biometric data if required.

- Receive your account details and welcome kit.

Online Process

- Visit the Great Western Bank website.

- Navigate to the “Open an Account” section.

- Fill out the online application form.

- Upload scanned copies of required documents.

- Complete the e-KYC process.

- Verify your identity via a video call or OTP.

- Receive your account details via email.

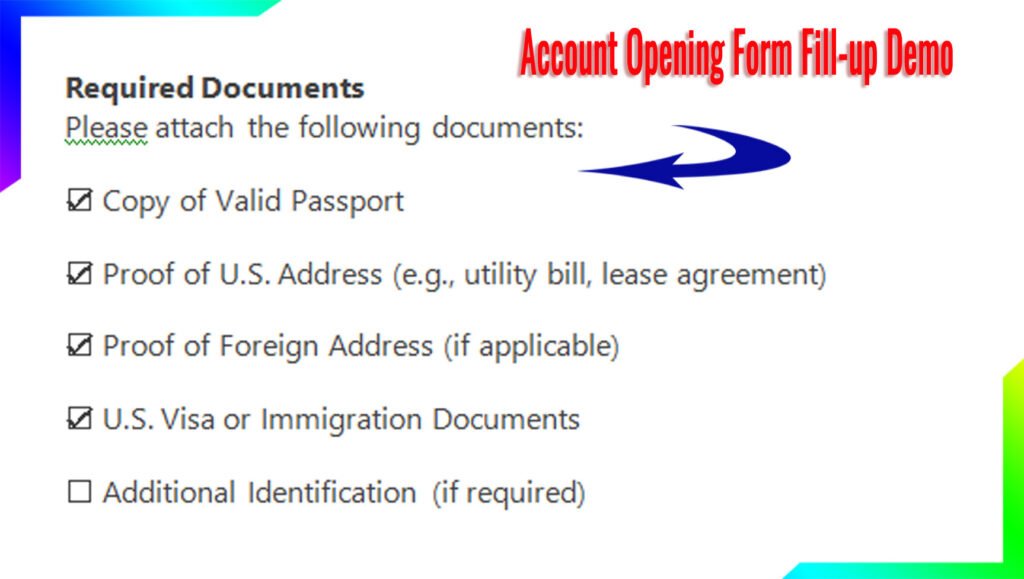

Required Documents

- Valid passport with visa.

- Proof of address (utility bill or rental agreement).

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Proof of income or employment (if applicable).

KYC and Biometric Updates

Great Western Bank requires KYC verification for all account holders. Biometric updates, such as fingerprints or facial recognition, may be required for enhanced security.

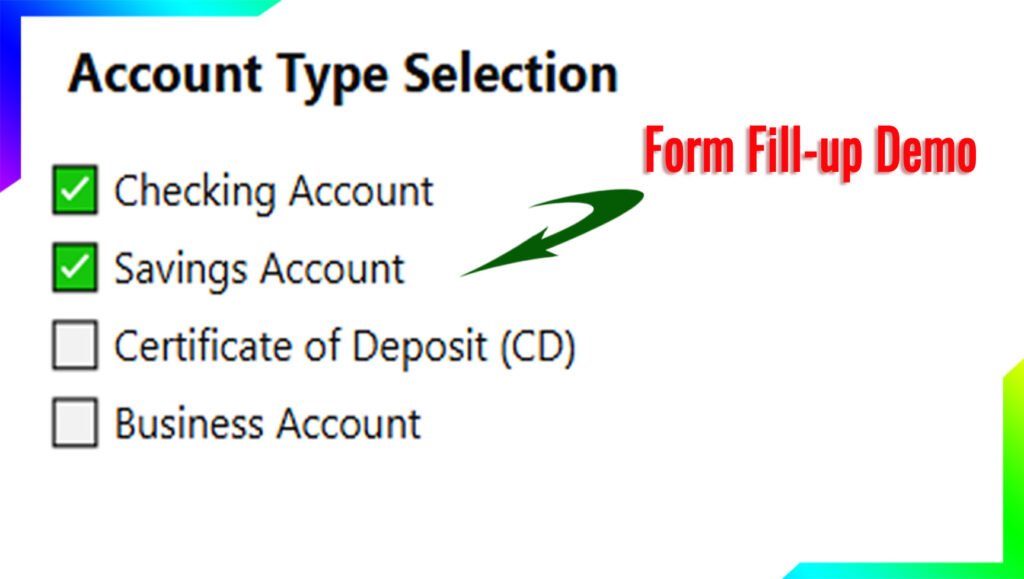

Account Types

- Savings Account

- Checking Account

- Fixed Deposit Account

- Senior Citizen Account

Account Opening Charges

- No account opening fees for basic savings and checking accounts.

- Fees may apply for premium accounts or additional services.

Minimum Balance

- Savings Account: $25

- Checking Account: $50

Interest Rates

- Daily Interest Rate: 0.01% – 0.05%

- Yearly Interest Rate: 0.50% – 1.50%

- Fixed Deposit Rates: 2.00% – 3.50% (varies by tenure).

Senior Citizen Schemes

Great Western Bank offers higher interest rates and exclusive benefits for senior citizens, including priority banking and discounted insurance plans.

MIS Scheme

The Monthly Income Scheme (MIS) provides a fixed monthly income with competitive interest rates.

Insurance

Great Western Bank offers life insurance, health insurance, and account protection plans.

Mobile Apps and Online Payment Methods

- Mobile App: Manage your account, transfer funds, and pay bills.

- Online Payment Methods: PayPal, Zelle, and direct bank transfers.

Customer Facilities

- 24/7 customer support.

- Free online banking.

- Access to over 10,000 ATMs nationwide.

New Updates in 2025

- Enhanced mobile app features.

- Lower fees for international transfers.

- Introduction of cryptocurrency investment options.

FAQ

- Can I open an account without an SSN? Yes, with an ITIN.

- Is there a fee for online banking? No, it’s free.

- Can I open an account remotely? Yes, via the online process.