Rabobank USA is a trusted financial institution offering a range of banking services tailored to meet the needs of both residents and non-residents. If you’re a foreigner looking to open a Rabobank USA account, this guide will walk you through the process, required documents, fees, and more.

Bank Description

Rabobank USA is a subsidiary of the Netherlands-based Rabobank Group, known for its focus on agriculture, food, and sustainability. It offers personal and business banking services, including savings accounts, fixed deposits, loans, and insurance.

How to Open a Rabobank USA Account for Foreigners 2025: Step-by-Step Guide

Offline Process

- Visit a Branch: Locate the nearest Rabobank USA branch.

- Consult a Bank Representative: Discuss your banking needs and account options.

- Submit Documents: Provide the required documents (listed below).

- Complete KYC & Biometric Updates: Verify your identity and complete biometric registration.

- Account Activation: Once approved, your account will be activated, and you’ll receive your account details.

Online Process

- Visit Rabobank USA Website: Go to the official Rabobank USA website.

- Choose Account Type: Select the account that suits your needs.

- Fill the Application Form: Enter your personal and financial details.

- Upload Documents: Submit scanned copies of required documents.

- Complete KYC & Biometric Updates: Follow the online instructions for identity verification.

- Account Activation: After approval, you’ll receive your account details via email.

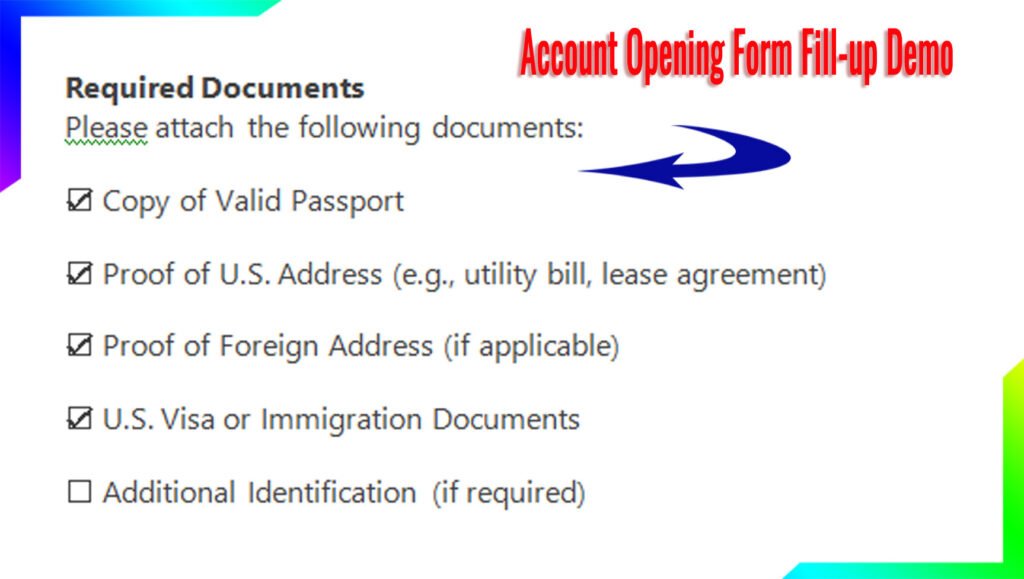

Required Documents

- Valid passport

- Visa or residency permit

- Proof of address (utility bill, rental agreement)

- Tax Identification Number (TIN) or Social Security Number (SSN)

- Initial deposit (if required)

Account Types

- Savings Account: Ideal for daily transactions and earning interest.

- Fixed Deposit Account: Earn higher interest with locked funds for a specific period.

- Senior Citizen Scheme: Special interest rates and benefits for seniors.

- MIS Scheme: Monthly Income Scheme for regular payouts.

Fees and Charges

- Account Opening Charges: $25 (may vary)

- Minimum Balance: $100 for savings accounts

- Daily Interest Rate: 0.01% – 0.05%

- Yearly Interest Rate: 1.5% – 2.5%

- Fixed Deposit Rates: 2.5% – 3.5% (for 1-year term)

Senior Citizen Scheme Facilities

- Higher interest rates on savings and fixed deposits.

- Dedicated customer support.

- Free insurance coverage up to $10,000.

Insurance and MIS Scheme

- Insurance: Rabobank USA offers life and health insurance plans.

- MIS Scheme: Earn monthly interest payouts with a minimum deposit of $1,000.

Mobile Apps and Online Payment Methods

- Rabobank Mobile App: Manage accounts, transfer funds, and pay bills.

- Online Payment Methods: Use Zelle, PayPal, or direct bank transfers.

Customer Facilities

- 24/7 customer support.

- Free online banking.

- Access to ATMs nationwide.

New Updates in 2025

- Enhanced mobile app features.

- Lower account opening fees.

- Introduction of cryptocurrency trading.

FAQ

- Can I open an account without an SSN?

Yes, but you’ll need a Tax Identification Number (TIN). - What is the minimum balance requirement?

$100 for savings accounts. - Are there fees for online transactions?

No, online transactions are free. - How long does it take to open an account?

Typically 3-5 business days.