How to Open an Account with Regions Bank USA for Foreigners: A Step-by-Step Guide

Opening a bank account in the USA as a foreigner can indeed seem challenging, but with proper preparation, it can be a smooth process. Regions Bank, like many other U.S. banks, offers services to non-residents, making it a viable option for foreigners. Here’s a step-by-step guide to help you through the process:

Step-by-Step Process to Open an Account

Step 1: Choose the Right Account Type

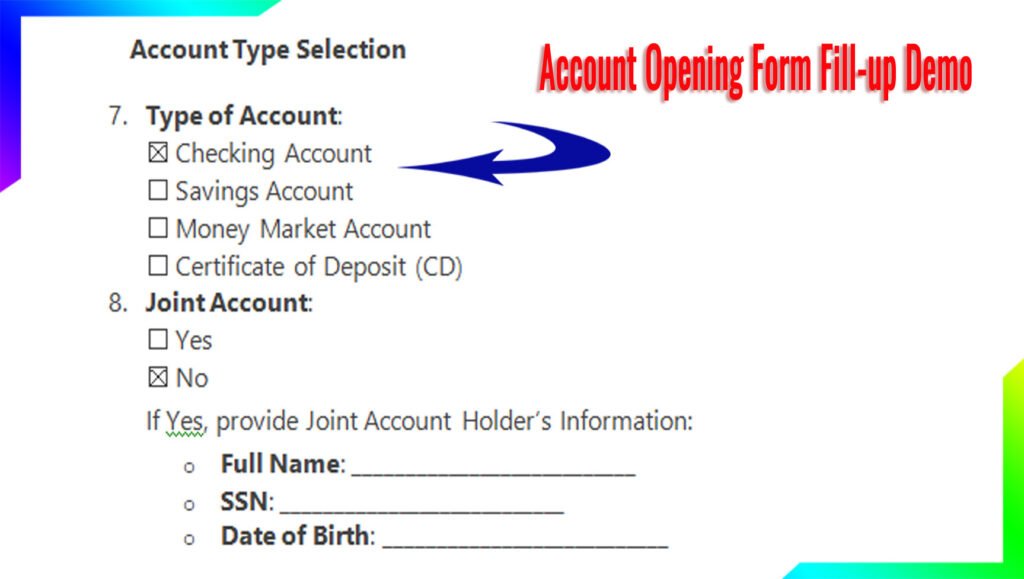

Regions Bank offers several account types, including:

- Checking Accounts: For everyday transactions.

- Savings Accounts: For saving money and earning interest.

- Certificates of Deposit (CDs): For fixed-term savings with higher interest rates.

- Money Market Accounts: A hybrid of checking and savings accounts with higher interest rates.

As a foreigner, you may want to start with a basic checking or savings account.

Step 2: Gather Required Documents

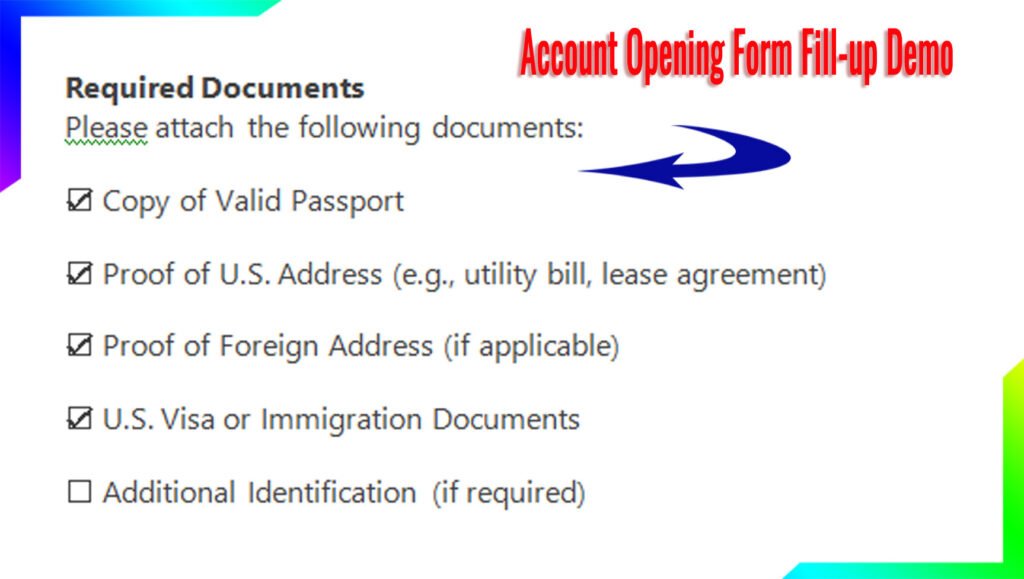

To open an account, you’ll need the following documents:

- Passport: A valid passport is mandatory for identification.

- Visa: Proof of your visa status (e.g., student visa, work visa, or tourist visa).

- Proof of Address: This can be a utility bill, rental agreement, or any official document with your name and US address.

- ITIN (Individual Taxpayer Identification Number): If you don’t have a Social Security Number (SSN), you’ll need an ITIN.

- Initial Deposit: Some accounts require a minimum deposit to open.

Step 3: Visit a Regions Bank Branch or Apply Online

- In-Person: Visit the nearest Regions Bank branch with your documents. A bank representative will guide you through the process.

- Online: Some accounts can be opened online. Visit the Regions Bank website and follow the instructions.

Step 4: Complete KYC and Biometric Updates

Regions Bank follows strict KYC (Know Your Customer) guidelines. You may need to provide additional information or undergo biometric verification (e.g., fingerprint scanning) for security purposes.

Step 5: Fund Your Account

Once your account is approved, you’ll need to deposit the minimum required amount. This varies depending on the account type.

Account Opening Charges and Minimum Balance

- Account Opening Charges: Most basic accounts have no opening fees, but premium accounts may charge a fee.

- Minimum Balance:

- Checking Accounts: 50–50–100.

- Savings Accounts: 50–50–300.

- CDs: 500–500–1,000.

Interest Rates

Regions Bank offers competitive interest rates. Here’s a general overview:

Daily Interest Rate Chart

- Savings Accounts: 0.01%–0.05% (varies based on balance).

- Money Market Accounts: 0.05%–0.10%.

Yearly Interest Rate Chart

- Savings Accounts: 0.50%–1.00%.

- CDs: 1.50%–3.00% (depending on the term).

Fixed Deposit Rate Chart

- 6-Month CD: 1.50%.

- 1-Year CD: 2.00%.

- 5-Year CD: 3.00%.

Senior Citizen Scheme Facilities

Regions Bank offers special benefits for senior citizens, including:

- Higher interest rates on savings accounts and CDs.

- Waived monthly maintenance fees.

- Free checks and money orders.

MIS Scheme and Insurance

- MIS (Monthly Income Scheme): Not currently offered by Regions Bank.

- Insurance: Regions Bank provides various insurance options, including life insurance, home insurance, and auto insurance, through its partners.

Mobile Apps and Online Payment Methods

Regions Bank offers a robust online banking system and mobile app:

- Mobile App: Available on iOS and Android, the app allows you to check balances, transfer funds, pay bills, and deposit checks.

- Online Payment Methods: Use Zelle, Apple Pay, or Google Pay for seamless transactions.

Customer Facilities

- 24/7 Customer Support: Call 1-800-734-4667 for assistance.

- ATM Access: Over 1,500 ATMs nationwide.

- Fraud Protection: Advanced security features to protect your account.

New Updates in 2025

Regions Bank is expected to introduce:

- Enhanced mobile app features, including AI-driven financial insights.

- Lower fees for international transfers.

- Expanded cryptocurrency services.

FAQ

1. Can I open an account without an SSN?

Yes, you can use an ITIN (Individual Taxpayer Identification Number) instead.

2. What is the minimum deposit for a checking account?

The minimum deposit is typically $50.

3. Can I open an account online as a foreigner?

Yes, but you may need to visit a branch for verification.

4. Are there fees for international transfers?

Yes, fees apply, but they may be reduced in 2025.

5. Can I open a joint account with a US resident?

Yes, joint accounts are allowed.